Trump’s Desperation for India Trade Deal

Image Source: BusinessToday

1. The Economic Reality Behind Trump’s Aggressive Stance

Trump’s apparent level of desperation for a trade deal with India is shaped by complex factors on economic, geopolitical, and domestic political planes that make India an attractive yet challenging target for his “America First” agenda.

The Numbers Don’t Lie

Trade Deficit as the Primary Driver

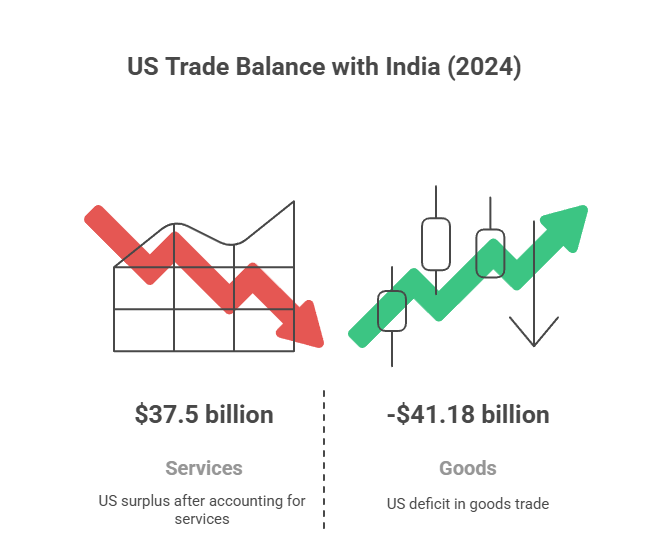

The US had a $45.7 billion trade deficit with India in 2024, representing a 5.9% increase from the previous year. These trade deficit figures heavily into Trump’s narrative because he views the trade deficit as a symptom and consequence, or manifestation of unfair trading relationships. India exported $86.51 billion in goods to the US in 2024-25, while importing $45.33 billion in goods from the US, resulting in a $41.18 billion trade surplus in goods.

The Full Economic Context of US-India Trade

However, this narrative begins to collapse when the full economic context is examined. In the report, Navigating the Service Sector, produced by the Global Trade Research Initiative (GTRI), it was stated that when services, education, arms sales and royalties on intellectual property are factored in, the US has a $35-40 billion surplus with India. Just in the education sector, Indian students, who contribute $7.7 billion to the US economy, go on to the American system of higher education, with over 320,000 Indian students studying in American higher education institutions.

India’s Strategic Economic Importance

India has been the biggest trading partner of the US in each of the last four years, with total bilateral trade reaching $131.84 billion in 2024-25. The US is also the third-largest foreign investor in India. From 2000-2024, India received total FDI inflows from the US of $65.19 billion.

2. Why Trump is “Desperate”: Competing Strategic Imperatives

1. Geopolitical Competition with China

Trump’s urgency is driven in part by the need to counterbalance China’s influence in Asia. India is the largest democracy in the world and the fifth-largest economy on the planet. India poses a critical counterbalance to China’s growing power. Ironically, threats of tariffs from Trump are driving India closer to China and the other BRICS nations, which undermine US economic and strategic objectives.

2. Domestic Political Calculation

The trade deficit with India provides Trump with a highly visible number to show any domestic audience to demonstrate the success of his trade policy. While the relationship with China is much more complex, India is a more straightforward trade target that Trump can pursue to at least demonstrate success with negotiations without incurring the kind of systemic risk associated with a trade war with Beijing.

3. Oil Leverage from Russia

Trump has an easy excuse for tariffs, considering India’s purchasing of $52.73 billion of Russian oil in 2024 ($52.73 billion in total purchases of 36% of India’s crude import). Trump can present the trade dispute as supporting Ukraine while pursuing a broader economic agenda.

The Economics of Trump’s Approach

| Metric | Value | Context |

| Bilateral Trade (2024-25) | $131.84 billion | US is India’s largest trading partner for 4th consecutive year |

| India Exports to US (2024-25) | $86.51 billion | 11.6% increase from previous year |

| US Exports to India (2024-25) | $45.33 billion | 11.6% increase from the previous year |

| US Trade Deficit with India (2024) | $45.7 billion | 5.9% increase from 2023 |

| India Trade Surplus with US (2024-25) | $41.18 billion | Significant trade surplus for India |

| Indian Students in the US (2023) | 320,260 students | Major source of US higher education revenue |

| Student Economic Contribution | $7.7 billion annually | 7.44% increase from the previous year |

| US FDI in India (2000-2024) | $65.19 billion | 3rd largest investor in India |

| Services Trade (2024) | $83.4 billion | Balanced services trade |

| Goods Trade (2024) | $128.9 billion | Total goods trade between the two countries |

| Russia Oil Imports (2024) | $52.73 billion | India’s imports from Russia in 2024 |

| Russia’s Share of India’s Oil Imports | 36% | Russia is India’s top oil supplier |

| Current US Tariff Rate | 25% | Implemented August 7, 2025 |

| Proposed Additional Tariff | 25% | Additional penalty for Russian oil purchases |

| Total Proposed Tariff Rate | 50% | Among the highest globally imposed by the US |

3. Escalating Tariffs as Negotiation

Trump has taken an incremental approach:

- Initial 25% tariff on August 7, 2025,

- 30% additional tariff effective Aug 27, 2025

- 50% total tariff – one of the highest globally imposed by the US.

This strategy, which follows his negotiation playbook of maximum pressure, aims to extract concessions. Therefore, it would be helpful to have some discussions with other partners, such as South Korea, that accepted a 15% tariff after agreeing to commit $350 billion in investment and increased energy imports.

Impact on American consumers

The imposition of 50% US tariffs on Indian goods is causing significant inflationary pressure for American consumers, who are increasingly bearing the financial consequences of the ongoing trade dispute initiated by the Trump administration. An analysis by Goldman Sachs indicates that while US corporations initially absorbed most tariff-related costs, consumers are expected to bear 67% of this burden by October 2025. This marks a substantial increase from the mere 22% observed through June. This shift is projected to raise the core Personal Consumption Expenditure (PCE) inflation index to 3.2% by December 2025, with approximately 0.7 percentage points of this increase directly attributable to tariffs, notably exceeding the typical inflation rate of 2.4%. In July, the Producer Price Index registered a 0.9% rise, representing the most considerable monthly increase in three years, as US importers faced record-high tariff collections approaching $30 billion within a single month.

4. Tariffs as Hidden Taxes on American Households

The imposition of tariffs is anticipated to have a particularly severe impact on consumers, especially concerning everyday goods imported from India, with notable price increases already observed. Organic chemicals are subject to a cumulative duty of 54%, carpets 52.9%, knitted apparel 63.9%, textiles 59%, and gems and jewellery 52.1%. Essential commodities such as furniture, machinery, and select food products will become significantly more expensive for American households. These tariffs effectively function as a tax on American purchasers. Retailers and wholesalers are escalating prices to maintain profit margins, as evidenced by the 2% increase in wholesaler margins reported in July’s inflation data. This constitutes a clear instance of tariff pass-through, wherein businesses initially absorb costs, subsequently leading to elevated consumer prices, thereby compelling American families to bear the financial burden of trade policies through augmented checkout costs.

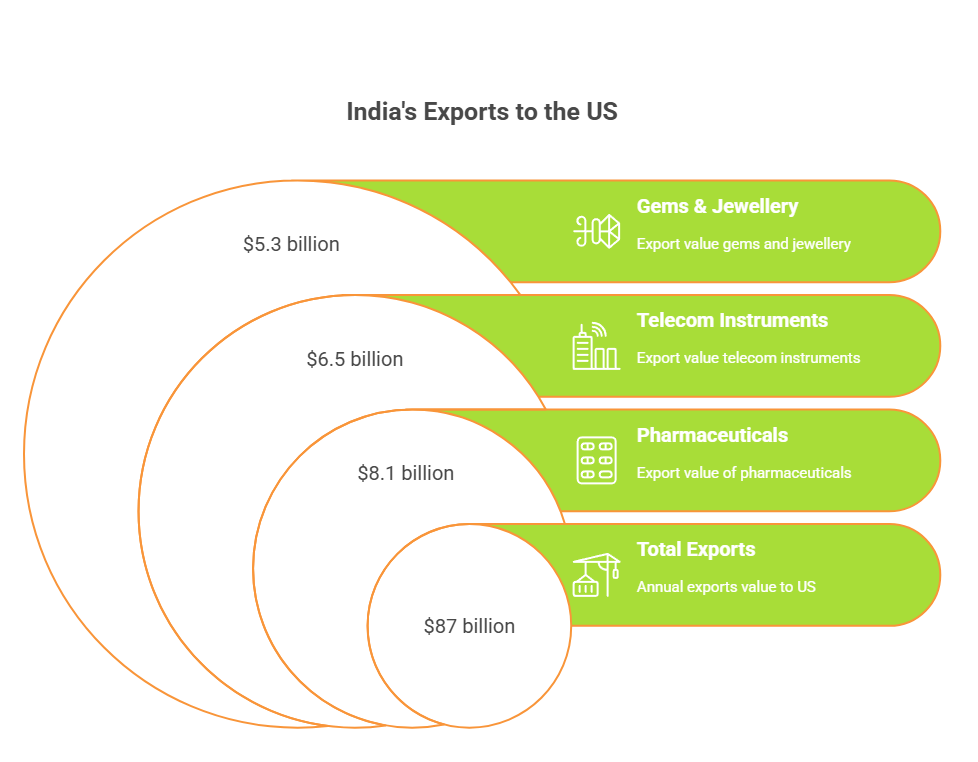

5. Economic Impact on India

The 50% tariff is endangering India’s annual exports of $87 billion to the US. At the highest levels of this tariff, the exports may simply be non-commercially viable. The sectors that will be most affected include:

- Pharmaceuticals: $8.1 billion

- Telecom instruments: $6.5 billion

- Gems and jewellery: $5.3 billion

- Textiles and diamonds: 2 million people employed

S&P Global estimates that the tariffs will take between 0.1 to 0.3% off India’s GDP growth in the short term, noting that India is fortunate to have no domestic pressures because its economy is particularly driven by domestic consumption levels.

6. Strategic Miscalculations in Trump’s Approach

India’s Strategic Autonomy Doctrine

Unlike other countries that capitulated to Trump’s demands, India expressly retains strategic autonomy, which allows it to not only engage with multiple powers at once but also forces those powers to essentially share India with others. Under this doctrine, India has been able to:

- Play both QUAD (with the US, Japan, Australia), along with BRICS (with China, Russia);

- Get updates on where its allies are in their foreign policy choices on numerous occasions without needing to compromise any independent foreign policy decisions.

- Place its strategic autonomy as one of its subtler, but more socially connective, national core interests in the sovereign defence issue alongside India’s capacity for resistance to external pressure on important sovereignty issues;

Pushing India Toward China

Trump’s pressure tactics are leading to unexpected results. India and China have started to normalise their relations. This includes:

- Direct flights resuming after five years

- Modi’s planned visit to China for the first time since 2018

- Border trade restarting through designated points

- Tourist visa resumption between the two nations

This improved relationship shows a strategic failure for US policy. It weakens America’s strategy to shift focus to Asia, which aimed to position India as a democratic counterbalance to China.

7. The Broader Geopolitical Context

BRICS as an Alternative Framework

India’s involvement in BRICS gives it other economic and diplomatic options that lessen reliance on the US. The expanded BRICS+ now accounts for 45% of the global population and 36% of global GDP, giving India considerable power in negotiations.

Selective Enforcement Concerns

Trump’s focus on India while continuing trade talks with China, which buys even more Russian oil, raises doubts about the consistency of US policy. This uneven approach damages the credibility of the Russian oil rationale for tariffs.

8. Economic Fundamentals Favouring India

Diversified Economy Structure

India’s economy relies less on trade, with 60% of its growth coming from domestic consumption. This setup offers protection against external trade shocks. In contrast, economies that depend heavily on exports are more vulnerable to pressures from the US.

Alternative Market Access

India is working to diversify its trade relationships. It is currently negotiating free trade agreements with the EU, UK, and several Asian markets. This effort decreases the advantage that exclusive access to the US market used to provide.

9. Conclusion: Desperation Meets Reality

Trump’s need for an India trade deal shows a mix of economic goals, competition with China, and domestic political pressure to show success in negotiations. However, his aggressive approach fails to grasp India’s strategic culture and economic situation.

The irony is that Trump’s pressure tactics result in the opposite of what he wants. Instead of making India comply, they drive New Delhi closer to Beijing and encourage it to pursue greater strategic independence. This is a serious miscalculation that could have long-lasting effects on US influence in Asia.

Economic data show that while the US has a goods trade deficit with India, the overall economic relationship benefits America when we consider services, education, and investment. Trump’s emphasis on narrow trade figures while overlooking broader strategic advantages highlights the drawbacks of a purely transactional view of international relations.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.info/hu/register-person?ref=IQY5TET4

Rongbbachkim, eh? Just gave ’em a looksee. Seems promising, alright? You might dig it! rongbbachkim

Yo, checked out vina24h recently. Seems legit, pretty easy to navigate. Good vibes, decent selection. Definitely worth a look if you’re trying to find something new. Check them out here: vina24h

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/tr/register?ref=MST5ZREF

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.