The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over half of the global population and drives much of the growth. Its economies make up about 60% of global GDP. Important sea lanes in this area carry a similar portion of trade. For instance, nearly 60% of global maritime trade passes through the Strait of Malacca and nearby waterways. The South China Sea alone handles about one-third of the world’s shipping tonnage. Major economies in the Indo-Pacific—China, Japan, India, the ASEAN states, Australia, and the U.S.—all depend heavily on these routes. In summary, the region’s essential waterways, resource wealth, and growing markets make it a key player in world commerce and a centre of geopolitical competition.

Major Trade Routes: Malacca and the South China Sea

Two choke points highlight this geoeconomic significance. The Strait of Malacca, located between Malaysia and Sumatra, is one of the busiest waterways in the world. Over 90,000 vessels pass through each year, linking Asia to the Indian Ocean. This narrow passage connects nine of the ten busiest ports globally. Experts say that about 60% of world maritime trade (by volume) travels through the Malacca-Singapore complex. This means roughly two-thirds of China’s sea-borne trade, 40% of Japan’s, and about one-third of all global trade. Therefore, controlling Malacca or facing disruptions there could create major problems for global supply chains, including oil and gas imports and manufactured goods.

The South China Sea (SCS) is a vital strategic junction. Approximately 80% of global trade is seaborne, with 60% passing through Asian waters. One-third of global shipping traverses the SCS, making it crucial for Asian economies. An estimated $3–5 trillion in trade flows through this region annually (20–30% of world trade). Over 64% of China’s and 30% of India’s seaborne trade use the SCS. Any disruption would cause costly and lengthy detours around Africa.

Territorial disputes over islands like the Spratly and Paracel in the South China Sea, involving China, Vietnam, the Philippines, Malaysia, Taiwan, and others, create a dangerous situation. Frequent standoffs occur as China builds bases on contested reefs while the U.S. and allies conduct freedom-of-navigation operations. Experts warn that conflict could disrupt global supply chains. Control of these vital Indo-Pacific sea routes is essential for global commerce, with threats directly impacting worldwide economies.

Maritime Security and Economic Decisions

Given the significant sea trade in this area, military presence and maritime security directly impact economic policy. Major powers, like the U.S., China, Japan, and India, patrol these waters with large navies to protect sea lanes and deter piracy. However, increased military tension raises insurance costs and can force trade route changes. For example, piracy or accidents in Malacca can cause major delays, as seen with a 2021 oil spill. China’s “Malacca Dilemma”—fear of the strait being blocked—has prompted investments in alternative routes, such as pipelines through Myanmar and rail corridors to Europe.

A UK Parliament report warned that China’s South China Sea claims could disrupt crucial sea routes, impacting the flow of semiconductors and other goods, leading to significant economic consequences. While open blockades are avoided in peacetime, the risk of escalation prompts governments to plan backup supply chains, including stockpiling and diversifying shipping lanes. The Biden Administration’s Indo-Pacific Economic Framework aims to reduce supply chain risks by establishing networks of trusted partners, preventing single crises from crippling economies. Ultimately, military and security factors directly influence economic decisions, as companies and states weigh the costs of friendshoring and alternative routes against conflict risks.

Strategic Players: China, India, U.S., Japan and ASEAN

The strategic competition in the Indo-Pacific involves both rising and established powers:

China

China has emerged as the largest economy and navy in the region. It claims most of the South China Sea and is quickly militarising the area. At the same time, China has invested hundreds of billions into the Belt and Road Initiative (BRI), which funds ports, rail lines, and digital infrastructure across Asia and beyond. BRI now involves 147 countries, which includes two-thirds of the world’s population and 40% of global GDP; this shows how China’s influence is expanding. Its extensive trade networks link many Asian countries economically to Beijing. China is also trying to act as a regional security provider, engaging in anti-piracy patrols and joint naval exercises, while asserting its power in territorial disputes.

The United States

The United States continues to be a significant Pacific power. It has strong allies and bases from Japan and South Korea to Singapore and Guam. Washington is promoting an Indo-Pacific strategy aimed at creating a “free, open, and resilient” region. Initiatives like AUKUS (the Australia-UK-US defence pact) and reviving the QUAD (U.S., Japan, India, Australia) seek to contain Chinese influence and ensure security. Economically, the U.S. does not have a significant new free-trade deal in Asia, but it launched the Indo-Pacific Economic Framework (IPEF) in 2022 as a non-binding partnership that covers trade, supply chains, clean energy, and anti-corruption among 14 countries. IPEF aims to strengthen ties between Indo-Pacific economies and the U.S. while decreasing dependency on China. However, analysis shows that IPEF members still heavily rely on China for trade.

India

India is another major power in the region, with an economy among the top five globally and a large coastline along the Indian Ocean. New Delhi positions itself as a counterbalance to China. It plays a leading role in the Quad and recently hosted its summit, which strengthened joint initiatives in defence, technology, and supply chains. India’s policies—Act East, SAGAR (Security and Growth for All in the Region), and the Indo-Pacific Oceans Initiative—focus on connectivity, rule of law, and inclusive development. While India avoids formal alliances, it has strengthened relations with the U.S., Japan, Australia, and ASEAN, while also interacting with Russia and Iran.

As noted by an Indian think tank, India is a “resident power” in the Indian Ocean with important interests in maritime security, economic engagement, and stability. New Delhi’s balancing act between close ties to the West and its own strategic independence makes it an essential player. For example, Japan and Australia publicly advocated for including India in IPEF negotiations, highlighting its strategic importance.

Japan and ASEAN

Japan and ASEAN also have important roles. The world’s third-largest economy has significant sea routes through Southeast Asia. It champions multilateralism, as seen with the CPTPP trade pact, and supports a “Free and Open Indo-Pacific.” Japan has enhanced its military, partnered with Australia in signing the U.S.-AUKUS agreement on submarines, and engages ASEAN through ADB investments and security discussions. The ASEAN nations, comprising 10 Southeast Asian countries, stand at a crucial intersection; together they represent over 600 million people and a growing bloc. Many ASEAN countries have joined RCEP or are seeking investment from various sources. ASEAN itself aims to mediate between China and its Southeast Asian neighbours, but its members have diverse allegiances.

Shifting Alliances and Economic Frameworks

Asia’s players have formed new groups and trade connections, reshaping supply chains:

Belt and Road Initiative (BRI)

China’s infrastructure drive, costing over $1 trillion, spans ports, railways, pipelines, and 5G networks across the Asia-Pacific and beyond. BRI projects link China directly to Europe via Central Asia, South Asia through Pakistan’s Gwadar port, and ports in ASEAN, Africa, and Latin America. By building new routes, BRI aims to secure Chinese trade and influence, creating new supply chains under Beijing’s control. Critics warn that BRI could serve as a “Trojan horse” for China-driven development and military growth.

IPEF (Indo-Pacific Economic Framework)

Launched by the U.S. in 2022, IPEF includes 14 countries (such as India, Japan, and ASEAN states, but notably not China). It focuses on trade standards, supply-chain resilience, green technology, and anti-corruption. While it lacks tariff cuts, it seeks to strengthen economic ties among democracies. In 2023, member states signed a supply-chain agreement to anticipate and lessen disruptions. The aim is to create a trusted network of suppliers for essential goods like semiconductors and rare earths, so that issues in China do not disrupt allied economies. However, reports show IPEF members still have substantial trade connections with China. Japan and Australia have pushed for India’s inclusion in IPEF to improve strategic balance, highlighting New Delhi’s importance.

QUAD and AUKUS

These focus on security but also have economic aspects. The QUAD (U.S., Japan, India, Australia) meets often and has started supply-chain projects involving critical minerals, vaccine production, and climate technology, along with joint naval exercises. Leaders describe it as a “force for global good” and a driver for alternative, reliable value chains. The AUKUS pact (Australia, U.S., UK) commits Australia to purchase nuclear submarines and share advanced defence technology, indicating closer strategic ties among these English-speaking democracies. While AUKUS is mainly military, it also suggests closer collaboration in technology and industrial sectors, including microchips and AI.

Regional Trade Blocs

Asia’s nations are creating an economic network. The Regional Comprehensive Economic Partnership (RCEP), effective since 2022, unites 15 Indo-Pacific countries (the 10 ASEAN members plus China, Japan, South Korea, Australia, and New Zealand). It is now the world’s largest free-trade area, covering about 30% of global GDP. RCEP lowers tariffs on most goods and aligns regulations, strengthening “Factory Asia” supply chains. Meanwhile, the CPTPP (11 countries) and other agreements connect ASEAN with North American and Pacific economies. Notably, the U.S. is not part of RCEP or CPTPP, leading it to depend on IPEF and bilateral agreements.

Why Control of These Routes Matters

- Global Trade Chokepoints: Two-thirds of trade between Asia and Europe, along with about 40% of global GDP, relies on shipping in the Indo-Pacific. No region outside Asia is completely free from disruptions. For instance, closing the Malacca Strait would force large ships to travel around Africa’s Cape of Good Hope, which would add weeks to their journey and increase fuel costs. Similarly, if the South China Sea faced blockades or conflicts, prices for oil, gas, and containerised goods would rise globally. Countries that depend on imports, like Japan, South Korea, and those in Europe, would experience immediate shortages.

- Resource Security: The Indian Ocean and South China Sea are crucial routes for energy supplies. China obtains about 80% of its oil through the Malacca Strait, so a blockade would pose a serious threat to its economy. Additionally, important raw materials pass through these bodies of water. According to GIGA research, the Indo-Pacific contains a significant portion of the world’s rare earths and semiconductors. Consequently, controlling these waterways is essential for economic security or influence.

- Economic Leverage: Those who control these shipping routes gain power in negotiations. China’s land bridges, including pipelines to Myanmar and rail connections to Kazakhstan, are partly meant to lessen its reliance on the Malacca Strait. The U.S. and its allies have suggested alternative routes, such as the Asia-Africa Growth Corridor with Japan and expanded use of the Panama Canal, to keep these routes accessible. In short, the geography of maritime trade shapes commercial success, making control of the seas in the Indo-Pacific vital for all major trading nations.

How Military Presence Affects Commerce

- Naval Deterrence: A strong naval presence by the U.S. 7th Fleet, the Chinese South Sea Fleet, and others helps ensure freedom of navigation and discourages piracy. For example, international patrols have significantly reduced piracy off Somalia and deterred attacks in Malacca. Major powers also keep bases, such as the U.S. in Japan and South Korea, China in Djibouti and Hainan, and India in the Andaman-Nicobar Islands, to extend their reach.

- Costs of Tension: Every military standoff or accident increases costs. When China and Vietnam or the Philippines clash over fishing or drilling in the South China Sea, insurers raise risk premiums on cargo. Businesses often delay shipments until tensions calm. For instance, after a Chinese fishing vessel sank in 2016, maritime insurance rates for regional shipping briefly surged. Even peacetime militarisation raises defence spending, which affects economic decisions. Countries divert resources to build navies and submarines, like India’s new destroyers and Australia’s submarines under AUKUS, instead of investing in infrastructure.

- Economic Coercion: Countries may use trade restrictions as a tool for security. China has previously banned imports, such as phosphorus, pine timber, and wine, from South Korea and Australia to retaliate against policies it opposed. This “weaponisation” of economics makes governments cautious and fuels the demand for supply-chain diversification. The PIIE notes that U.S. allies have faced Chinese economic coercion, pushing them to look for alternative suppliers.

In short, navies and coast guards both secure trade and create costs. States must weigh the expense of maintaining a military presence against the benefit of safe routes. As one parliamentary report stated, “action to materialise [China’s] claims would disrupt vital sea routes,” with an economic impact so significant that imposing sanctions on China would also harm the world economy. This highlights how closely military and economic decisions are linked in the Indo-Pacific.

India’s Balancing Act

India has become a key player in this geopolitical landscape. It is the largest democracy and a significant power in the Indian Ocean, with a long coastline on both the eastern and western sides. India’s economy is growing rapidly, now exceeding $3 trillion, and its middle class is expanding. New Delhi aims to promote its interests through various channels:

Act East and SAGAR

India’s foreign policy promotes engagement with Southeast Asia, East Asia, and the Pacific. Its SAGAR doctrine, which stands for Security and Growth for All in the Region, focuses on a cooperative, rules-based order and inclusive development. India is investing in port projects like Chabahar in Iran and Sabang in Indonesia, as well as maritime awareness networks with the U.S., Australia, and Japan.

Coalitions

India plays a leading role in the Quad, collaborates on the trilateral I2U2 (India-Israel-US-UAE) concerning supply chains and technology, and is part of initiatives like the “Asia-Africa Growth Corridor” with Japan. At the same time, India engages with China through BRICS and the Shanghai Cooperation Organisation, carefully avoiding labelling the Quad as anti-China. Analysts point out that India envisions an “inclusive Indo-Pacific” and sees the Quad as a “force for global good,” not just a military alliance.

Economic Hub Potential

With its vast consumer market, India is a natural engine for growth. During COVID, it transformed into a hub for pharmaceuticals and services. India participated in talks for RCEP but ultimately decided against joining. It is advancing bilateral trade agreements with Japan and Australia. Tokyo and Canberra view India as vital to any supply chain network in Asia. India’s large population and growing manufacturing sector give it leverage; companies planning production now view India alongside China and Southeast Asia.

Strategic Location

India’s geographic position, controlling access to the Arabian Sea and having military bases in the Andaman and Nicobar Islands, allows it to influence the western approaches to the Malacca route. Western powers consider India a counterbalance to China. If India and China were to clash, as they did during the 2020 Galwan skirmishes, it would threaten the northern Indian Ocean routes. Therefore, India’s choices, such as whether to host foreign military assets and how to align economically, significantly impact regional stability.

Indo-Pacific: A New Battleground for Economic Dominance?

There is debate about whether the Indo-Pacific is just another arena for strategic competition or the new front for global economic power. Many signs suggest the latter:

- The economic stakes are enormous. This region accounts for 30–60% of world GDP, with $2–5 trillion in trade flows and vital resources. Any struggle for influence here impacts the entire globe.

- Rhetoric between great powers has increased. U.S. and Chinese leaders regularly accuse each other of trying to change the rules in Asia. Competing visions, like China’s sinocentric development model and the U.S.-led “Free and Open Indo-Pacific,” shape a lot of diplomacy.

- Trade and technology competition has sped up. Tactics like “friend-shoring,” export controls, and alliances such as IPEF, CPTPP, and Quad aim specifically to counter rival economic influence.

At the same time, Asia is very interdependent. China is the largest trading partner for many countries. ASEAN economies trade heavily with both the U.S. and China. Thus, the relationship is not zero-sum. Governments often balance the growth opportunities from Chinese ties against associated security risks. Many Southeast Asian nations, for instance, welcome Chinese investment through the Belt and Road Initiative but also strengthen military ties with the U.S. to mitigate risks. In practice, the economic contest in the Indo-Pacific involves developing parallel systems, like alternative infrastructure and supply chains, rather than just confrontation.

Ultimately, the Indo-Pacific is certainly a region marked by increasing geoeconomic rivalry. However, there is still room for cooperation through institutions like ASEAN, WTO rules, and regional trade agreements. One commentator suggests that avoiding outright “containment” or a new Cold War requires dialogue and inclusive growth that considers the interests of all nations.

Future Scenarios – Cooperation vs. Conflict

Two main futures can be imagined for the Indo-Pacific:

Cooperative Scenario

In the best case, major powers agree on guidelines and enhance mutually beneficial integration. Regional institutions and norms improve, such as finalising a multilateral code of conduct in the South China Sea. Infrastructure projects, like port links and digital networks, connect economies instead of dividing them. Trade agreements, including RCEP/CPTPP and U.S.-Quad frameworks, bring markets closer together. Supply chains become more resilient and diverse, but still interconnected. For example, India joins RCEP/CPTPP, and the U.S. re-enters CPTPP or a similar agreement. Under this scenario, growth in Asia could speed up, boosting global prosperity. India would use its position as a trade and technology hub, gaining new market access and investments from countries like Japan, the U.S., and the Gulf states. A stable Indo-Pacific could also support global recovery after the pandemic and climate efforts.

Conflict Scenario

In a more dangerous outcome, tensions between major powers increase. A flashpoint, whether over Taiwan, the South China Sea, or a border clash, could lead to sanctions, trade embargoes, or even limited military action. Supply chains would break into blocs, such as China-centred and U.S.-centred networks, with tariffs and restrictions on technology transfer. Shipping through contested waters could be disrupted or require armed escorts, greatly raising costs. Energy markets would face issues, leading to rising oil prices, if tanker traffic is threatened. The 2023 GIGA report warned that even a localised regional war would severely impact Europe’s economy since 30% of the world’s GDP and vital resources move through the Indo-Pacific. In this scenario, global trade growth might slow down or reverse, inflation could rise, and countries, including India, would shift budgets to defence. India’s strategic position would become risky, facing pressure to choose sides, and any disruption to trade routes, like the Malacca Strait, would affect its economy. India’s own border with China would remain a flashpoint, tying up resources. On the positive side, conflict could lead to a closer security partnership with the U.S. and its allies, but this would come with higher geopolitical risk.

In both futures, the stakes are global. The stability or turmoil of the Indo-Pacific will significantly affect the world’s economic health. Cooperation would allow Asia-Pacific countries, including India, to shape a rules-based order that aligns with their interests. In contrast, conflict could pull multiple economies into recession. As the GIGA analysis notes, 2,000 ships carry commerce to and from Europe through these waters every day, and any serious disruption would have widespread effects. India, positioned between the Indian Ocean and as a rising Asian power, will play a critical role: it could lead a multi-aligned order or be drawn into polarised conflict.

Conclusion

The Indo-Pacific has become the centre of geoeconomic competition. Control over its trade routes, freedom of navigation, and infrastructure networks leads to global economic power. The region’s key players, China, India, the US, Japan, and ASEAN, are all competing for influence through trade deals, military alliances, and investment plans. How this competition unfolds, whether through cooperation or conflict, will shape the future of global trade. India, due to its size and location, is in a pivotal position. Its strategies and partnerships will be vital in preventing conflict or achieving a cooperative balance in the Indo-Pacific.

The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over…

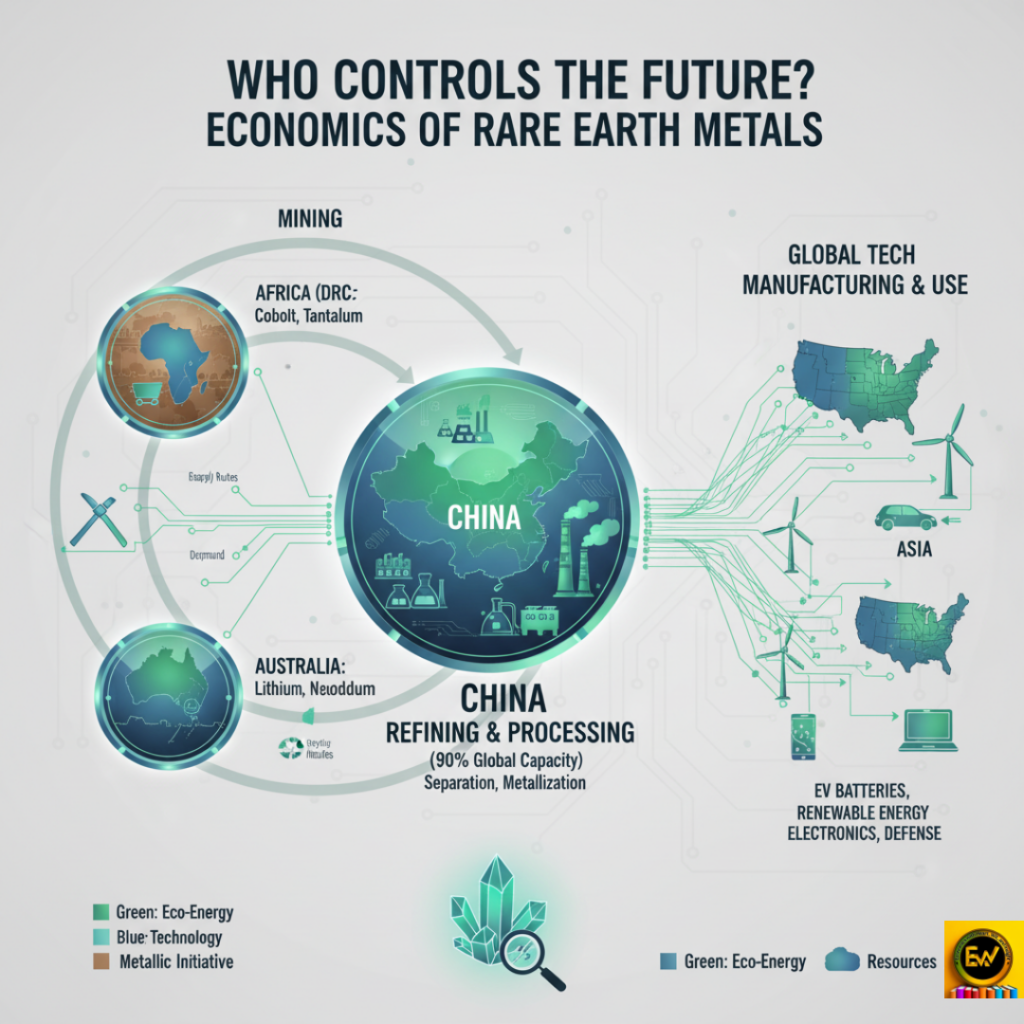

Economics of Rare Earth Metals

Rare earth elements and critical minerals are vital for clean energy and technology. They form…

Indian Rupee Depreciation Against the US Dollar

Introduction In recent years, the Indian Rupee has undergone significant depreciation against the US Dollar,…

Green Economy: Can India Balance Growth with Climate Goals?

India stands at a crucial point in history. As the world’s most populous nation and…

“Understanding ‘67’: The Viral Gen Alpha Slang That Became Word of the Year 2025”

Source – The Economic Times Every year, Dictionary.com selects a term that captures the spirit…

BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving…