MSMEs and the Future of Job Creation in India

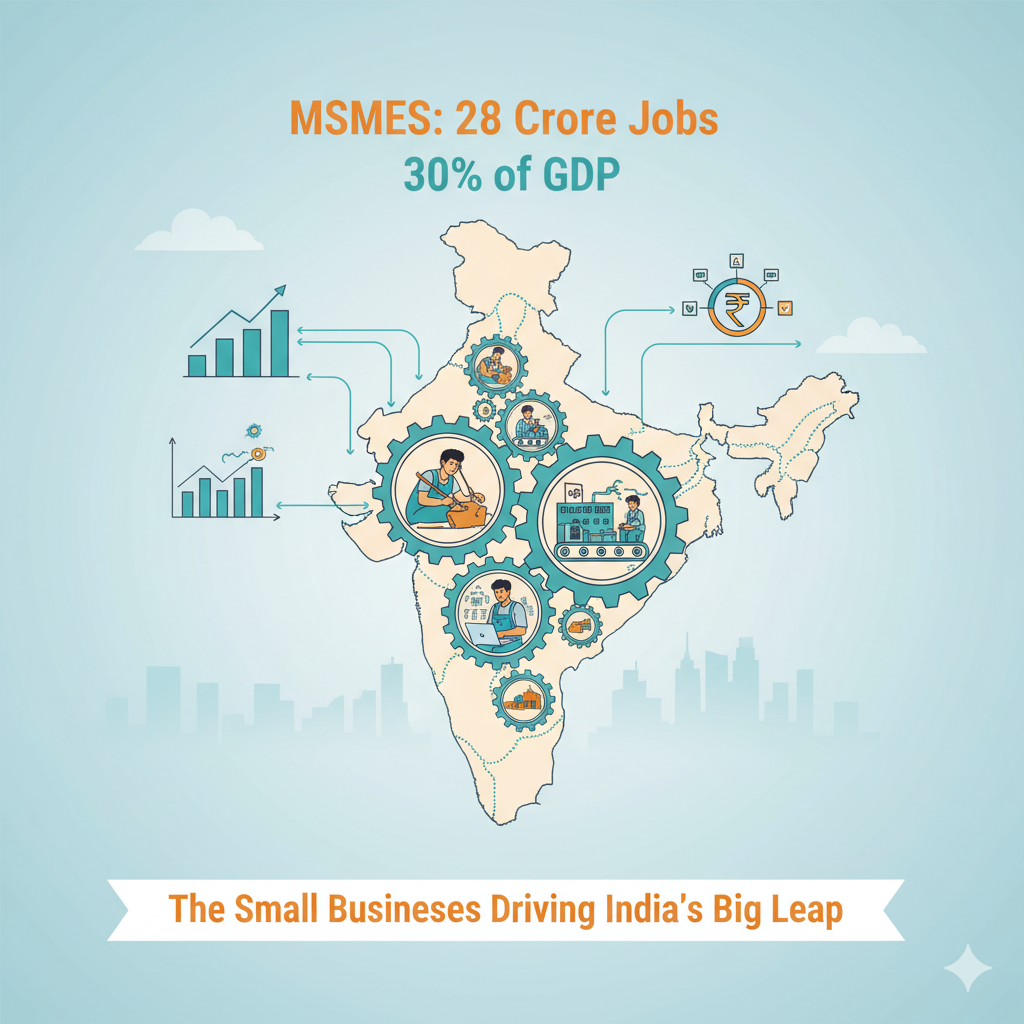

India’s growing workforce presents both opportunities and challenges. Official data shows that India’s labour force grew to about 64.3 crore in 2023, an increase of over 16.8 crore jobs since 2017. Unemployment has reportedly dropped to around 3.2%. However, maintaining this progress requires new sources of growth. Experts point out that India will supply nearly two-thirds of new global workers in the coming years, increasing the demand for job creation. In this situation, micro, small, and medium enterprises (MSMEs) have become India’s “silent job engine.” With around 6.5 crore MSME units, this sector provides jobs for approximately 28 crore Indians.

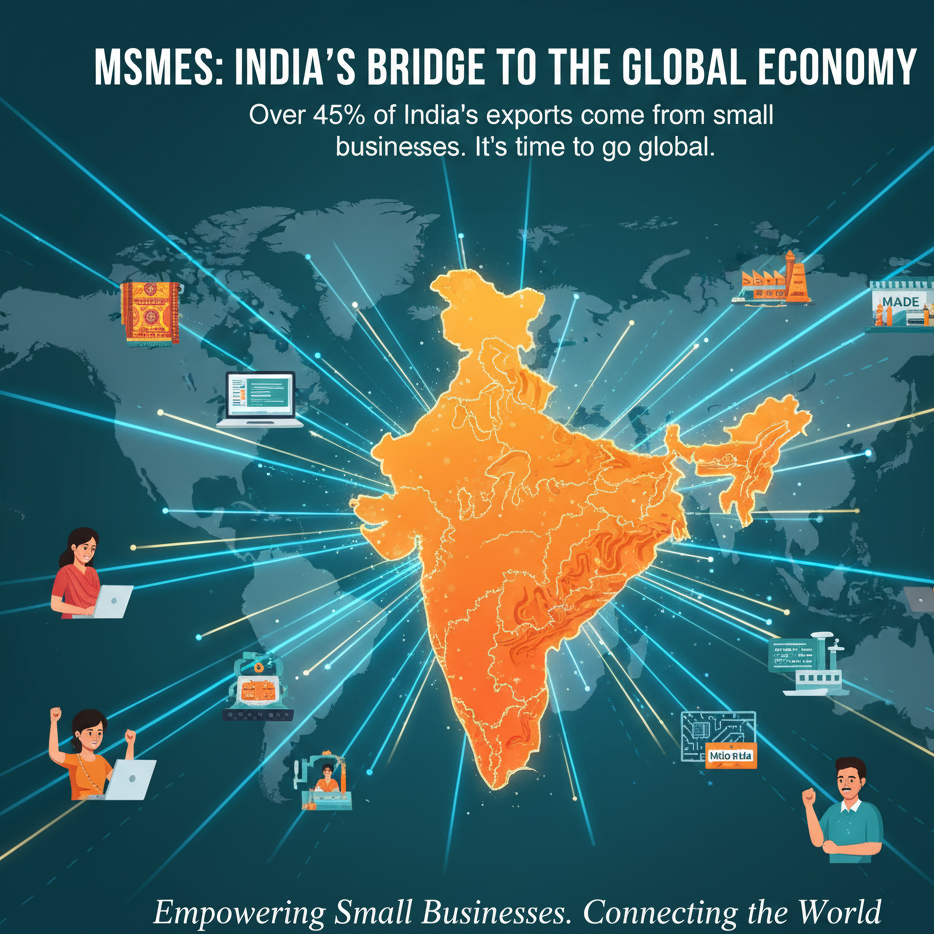

These businesses are not just small corner shops; together, they contribute to about 30% of India’s GDP and over 45% of India’s exports. It’s no surprise that MSMEs are seen as India’s second-largest employer after agriculture. The question is: can this huge small-business engine be adjusted to foster sustainable job growth and inclusive prosperity?

The Role of MSMEs in India’s Economy

MSMEs are crucial to India’s economy. They cover various industries, including manufacturing, services, trading, and agriculture. Official figures show that MSMEs contribute about 30.1% of GDP, 35.4% of manufacturing output, and nearly 45.7% of exports. One study reveals that India has over 63 million MSMEs, which generate around half of the country’s merchandise exports and roughly 30% of GDP. These businesses provide products to both rural and urban markets, with many also participating in global supply chains. For instance, one NITI Aayog report states that while only 0.3% of registered MSMEs are medium-sized, they account for about 40% of MSME exports. This indicates significant untapped potential for growing small firms.

MSMEs excel in providing employment. Government reports suggest that MSMEs employ over 28 crore people. Industry estimates indicate they create about 60–62% of India’s non-farm jobs. In fact, an analysis cited by McKinsey identifies MSMEs as India’s largest employer after farming. The global picture is even more striking. UN sources report that MSMEs and entrepreneurs make up about 90% of businesses worldwide and 60–70% of jobs.

In India, MSMEs drive inclusive growth, especially in rural areas and smaller towns. For example, India’s well-known khadi and village industries, a subset of MSMEs, saw their sales quadruple in the last decade due to rising rural demand. Many MSMEs are led by women. Initiatives like priority-sector lending and special programs, such as Mudra loans, have enabled women entrepreneurs. The share of women-owned MSMEs increased from about 17% in 2010 to over 26% by 2023–24. Approximately 10 crore Indians work in micro-enterprises, including many proprietary or self-employed units.

Challenges Faced by MSMEs

Limited Access to Finance

- The lack of collateral and credit history stops small businesses from getting bank loans.

- A SIDBI study estimates a credit gap of ₹30 lakh crore in India’s MSME sector.

- Micro-enterprises are the most underserved.

- Initiatives like CGTMSE and digital lending portals have provided some help, but a significant demand for financing still exists.

Low Technology Adoption

- Many MSMEs use old machinery and lack digital tools.

- They cannot afford modern equipment or use online sales and data analytics.

- This technological lag lowers their efficiency and restricts their integration with global value chains.

Skill Shortages

- Small firms struggle to compete with the wages and training offered by larger companies.

- They have trouble recruiting and keeping skilled workers, like machinists, coders, and designers.

- Almost 50% of MSME employees need additional training to meet new market demands.

Regulatory and Market Barriers

- High compliance costs for GST, labour laws, and permits hit small firms the hardest.

- The 2024 Economic Survey warns that excessive regulations:

- Hinder formalisation and labour productivity.

- Limit job growth and innovation.

- Entrepreneurs face hundreds of regulations every year, often with inconsistent enforcement.

Restricted Market Access

- Limited branding, marketing, and logistics capabilities shrink market reach.

- They cannot afford to participate in e-commerce contracts or international trade fairs.

- They struggle to meet global quality standards.

- They face tough competition from large domestic firms and imports.

- Infrastructure issues, such as unreliable power, poor roads, and weak broadband, especially in rural areas, make these challenges worse.

MSMEs and Employment Trends

Rural and Women-led Micro-Enterprises

Rural and women-led micro-enterprises have become essential in small towns and villages. A World Bank feature shows that women-run rural businesses employ 22 to 27 million people in India. These are often family businesses or self-help groups—think of women making bangles, spices, or garments from home. Meanwhile, official data reveal a significant increase in women entrepreneurs: the number of women-led MSMEs nearly doubled, growing from around 1.0 to 1.92 crore between 2010 and 2024. This growth created roughly 89 lakh new jobs for women in just FY2021 to FY2023. Programs like PM Mudra Yojana, which allocated 68% of loans to women, and Startup India, where 50% of new DPIIT-recognised startups have a woman director, aim to maintain this trend. In this way, MSMEs are not only providing jobs in rural areas but also expanding opportunities for female entrepreneurs, improving financial inclusion and household incomes.

MSMEs and the Gig Economy

At the same time, the gig economy is intersecting with MSMEs. Studies suggest that small firms will produce a large share of future gig jobs. For instance, a BCG analysis finds that MSMEs will lead in creating most new gig-based roles in sectors like manufacturing, transportation, construction, and personal services. Think of a local bakery hiring home bakers during festivals or a small studio engaging freelance photographers during wedding season. A café might bring on contract delivery riders, or a retailer could use ride-share couriers for the first and last mile.

In short, MSMEs today often act as platforms that engage gig workers or freelancers as needed, keeping costs low. This flexible labour model allows small businesses to create jobs based on real-time demand and provides part-time opportunities for urban youth and semi-skilled workers. However, regulatory changes will be necessary since heavy compliance costs can discourage MSMEs from hiring gig workers.

Together, these trends show that MSMEs are generating jobs across a range of demographics—from rural women and village artisans to urban gig workers. They create a more distributed and often informal employment engine compared to large factories. The key question is whether policies and markets can help make these jobs more stable, productive, and inclusive in the long run.

Future Outlook: Digital Platforms, AI and Government Schemes

Digital Platforms and E-Commerce Expansion

The digital era is opening new opportunities for small enterprises to access wider markets through e-commerce and online platforms.

- Government initiatives like ONDC (Open Network for Digital Commerce) aim to decentralise e-commerce, helping MSMEs sell online more easily.

- The MSME-TEAM scheme (launched in 2024) supports micro businesses by funding:

- Online cataloguing and digital visibility

- Logistics and packaging assistance

- Public procurement via GeM (Government e-Marketplace) has seen rapid growth:

- By 2024–25, over 10 lakh MSME sellers were onboarded

- Total gross sales exceeded ₹13.6 lakh crore

- These initiatives are part of a broader “Digital Economy and MSMEs” drive, including:

- Simplified registration through Udyam

- Faster digital lending via PSB Loans in 59 Minutes

- Promotion of fintech tools like QR-code payments at small shops

Impact: If effectively implemented, these digital measures can integrate many informal MSMEs into the formal economy, enhancing access to markets and finance.

Artificial Intelligence and Technological Transformation

AI and advanced technologies are becoming increasingly accessible to smaller firms.

- The IndiaAI Mission (launched March 2024)—with a ₹10,372 crore budget—aims to:

- Subsidise AI compute and cloud infrastructure

- Train the workforce in AI and digital skills

- Provide special grants for MSMEs to adopt AI

- In August 2025, a new ₹2,000 crore MSME-AI Fast Track Fund was introduced to:

- Help 50,000 firms adopt AI tools

- Support employee upskilling in AI and automation

- Practical implementations:

- AI-powered credit scoring by SIDBI and CGTMSE has:

- Reduced loan approval time by ~42%

- Expanded credit access to riskier small firms

- AI-based marketing, translation, and demand forecasting tools enable artisan MSMEs to reach international markets with minimal costs.

- AI-powered credit scoring by SIDBI and CGTMSE has:

- Current status:

- Only ~15% of Indian MSMEs have meaningfully implemented AI by 2025 — far below levels in the U.S. or China, indicating huge growth potential.

Global Comparisons and Lessons

The global prominence of Small and Medium-sized Enterprises (SMEs) as drivers of employment offers valuable insights. Globally, micro and small businesses constitute approximately 90% of all enterprises, providing 60–70% of total employment. Countries such as Germany, Japan, and China have historically cultivated robust SME ecosystems through deliberate policy interventions. Examples include Germany’s provision of low-interest loans via KfW and its cluster programs, Japan’s technical cooperative networks (keiretsu) and “one-village, one-product” initiatives, and China’s support for township-village enterprises in earlier decades. These models demonstrate that targeted assistance, particularly in the areas of technology, finance, and training, can significantly empower small businesses.

India can draw pertinent lessons from these international examples. Japan, for instance, offers subsidies to small manufacturers for modernisation and integrates them closely into export supply chains. In China, reforms that facilitated land use and credit access for small firms were instrumental in fostering rural entrepreneurship. Even in developing nations like Indonesia and Vietnam, the integration of digital marketplaces and microfinance, often in partnership with telecommunication networks, has enabled the scaling of numerous micro-ventures. A crucial conclusion is that Micro, Small, and Medium Enterprises (MSMEs) need not be confined to the limitations of “mom-and-pop” operations; with an appropriate enabling environment, they can transform into engines of growth. Significantly, nations where SMEs achieve success frequently combine skills training with entrepreneurship support and establish regulatory sandboxes to foster innovation. India’s experience suggests that a similar comprehensive effort is necessary, specifically addressing finance and technology gaps, mirroring the strategies of leading countries.

Policy Recommendations for Strengthening MSMEs

To realise MSMEs’ full potential, experts recommend multi-pronged reforms:

Bridge the credit gap:

We need to expand credit guarantees and explore innovative lending options. For instance, let’s enhance CGTMSE coverage and leverage AI and fintech for credit scoring, which could help unlock over ₹30 lakh crore in unmet demand. We should also encourage alternative financing sources like NBFCs and angel networks, while speeding up credit facilitation through GST.

Accelerate digital transformation:

It’s crucial to subsidise technology adoption. We can provide shared tech platforms, such as R&D centres and automation labs, along with digital literacy programs tailored for small entrepreneurs. Promoting platforms like ONDC and GeM will enable even the smallest firms to market their products online. Let’s incentivise the use of e-commerce, digital payments, and Industry 4.0 tools through grants or tax credits.

Strengthen export readiness:

We need to help MSMEs expand globally. This includes offering export training, making international certifications like ISO more accessible, and improving logistics and port infrastructure. We should enhance initiatives like Tata Digital’s NIRANTAR for e-training and organise trade fairs for MSMEs. Supporting the clustering of exporters, such as apparel hubs, can also help reduce costs and share best practices.

Build a future-ready workforce:

It’s important to integrate MSMEs into national skill programs. We can align initiatives like Skill India and Pradhan Mantri Kaushal Vikas Yojana with the specific needs of MSMEs. Developing modular apprenticeship and on-the-job training models in collaboration with industry will be beneficial. Additionally, we should encourage women’s employment through vocational training centres and childcare support, tapping into the vast potential of the female labour pool.

Ease regulatory burdens:

Let’s simplify compliance with one-stop solutions. Implementing unified filing portals, similar to an upgraded Udyam portal, and single-window clearances will streamline processes. We can use technology to cut down on paperwork, such as AI-driven assistants for permits, automated bookkeeping apps, and digital legal helpdesks. Lowering the thresholds for license requirements for small firms and regularly reviewing outdated regulations will also help ease the burden on small businesses.

Promote innovation and diversification:

Let’s spark some innovation and diversify our approach! We can boost research and development in micro, small, and medium enterprises (MSMEs) by providing matching grants or tax incentives. It’s also important to create connections with incubators and research institutes, like those tech hubs at engineering colleges. We should support budding “start-up” MSMEs with equity funding and incubation, similar to what we see in initiatives like Startup India and various state policies. We need to focus on helping medium enterprises grow, as they have significant export potential.

These reforms—many of which have already been suggested in budget and NITI documents—need to be implemented together. Bridging the gaps in finance and technology, enhancing skills, and reducing bureaucratic hurdles are all interconnected objectives. As one industry leader points out, India’s MSMEs “contribute nearly 30% to GDP and employ over 110 million people… yet access to timely and affordable credit remains a key barrier.” So, addressing these challenges isn’t just about welfare; it’s essential for our economic growth.

Conclusion:

MSMEs as Engines of Inclusive Growth India’s MSMEs have shown incredible resilience and growth, even in the face of global uncertainty. They currently contribute nearly one-third of the GDP and about half of the country’s exports, which is a significant leap from where they started. The big question now is how to supercharge this sector to create the millions of jobs that India desperately needs. The way forward is pretty straightforward: we need better access to credit, smarter technology adoption, and a more supportive business environment for small firms. If we guide them properly, MSMEs can evolve into more than just job creators; they can become hubs of innovation and inclusion.

By operating in rural and semi-urban areas and being flexible and responsive, they can help spread the benefits of India’s growth to every nook and cranny. As industry analysts put it, MSMEs “are not just economic contributors but potential accelerators of inclusive growth.” With the right policy support, these millions of small businesses can drive the “big leap” toward India’s 2047 goals, fostering jobs, entrepreneurship, and a fairer prosperity for everyone.

The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over…

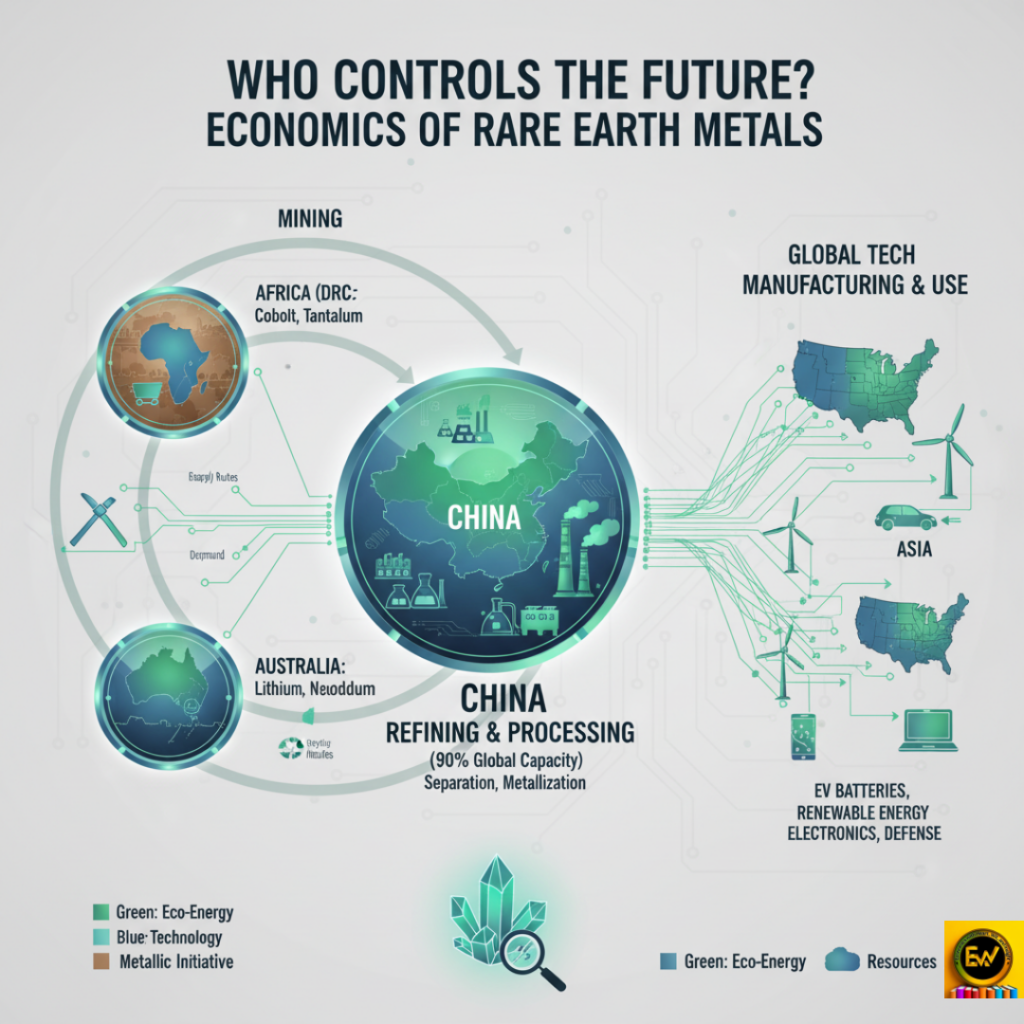

Economics of Rare Earth Metals

Rare earth elements and critical minerals are vital for clean energy and technology. They form…

Indian Rupee Depreciation Against the US Dollar

Introduction In recent years, the Indian Rupee has undergone significant depreciation against the US Dollar,…

Green Economy: Can India Balance Growth with Climate Goals?

India stands at a crucial point in history. As the world’s most populous nation and…

“Understanding ‘67’: The Viral Gen Alpha Slang That Became Word of the Year 2025”

Source – The Economic Times Every year, Dictionary.com selects a term that captures the spirit…

BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving…

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for shening. I read many of your blog posts, cool, your blog is very good.

Thank you for your kind words! I appreciate you taking the time to read multiple posts. I’m constantly working to improve the blog, so your feedback is truly encouraging. If you have any suggestions or topics you’d like me to explore, I’d love to hear them!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/ro/register-person?ref=HX1JLA6Z

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.