India’s Response to Trump’s 2025 Tariffs

Executive Summary

Trump’s August 2025 tariff escalation, which combines a 25% reciprocal tariff with a 25% penalty tariff for an effective rate of 50%, represents the harshest measures India has faced in two decades. While Washington justifies these tariffs as retaliation for India’s continued Russian oil purchases, they underscore the weaponization of trade policy as a foreign policy tool. Although India demonstrates macroeconomic resilience, with GDP largely insulated by domestic consumption, it suffers acute sectoral distress in textiles, shrimp, gems and jewellery, and auto components. In response, India adopts a pragmatic, multi-pronged strategy that includes tactical U.S. engagement, export diversification, structural reforms, and fiscal relief for vulnerable industries. Over the long term, this leads to the erosion of the “special partnership” narrative, as India pivots toward more transactional ties with the U.S. while simultaneously strengthening its self-reliance and deepening links with BRICS and the Global South.

1. Background & Genesis of the Tariff Crisis

On August 7, 2025, a 25% “reciprocal” tariff was introduced, citing the need to correct trade imbalance, and then on August 27, 2025, an additional 25% penalty tariff was imposed, explicitly linked to Russia crude purchases. Meanwhile, bilateral trade reached $191 billion in 2024–25, with India enjoying a $41 billion surplus, but the target of $500 billion by 2030 now faces strain. Additionally, China was spared similar sanctions despite its larger Russian imports, revealing a selective strategy that has damaged trust.

2. India’s Stance & Political Anchors

The MEA called the tariffs “unfair, unjustified, and unreasonable,” and PM Modi emphasized the non-negotiable defense of farmers, dairy, and fishermen as domestic red lines. Furthermore, India highlighted U.S. hypocrisy by pointing out continued Russian fertilizer and uranium imports. In addition, India reasserted its strategic autonomy and positioned itself as a non-Western, rather than an anti-Western, power.

3. Economic Impacts

At the macro level, S&P Global reports negligible GDP effects, with growth steady at 6.5%, and Credit Sights/Fitch warn of a potential GDP drag of up to 0.4% if tariffs persist. Moreover, ICRIER/GTRI highlight severe export losses ranging from $50 to $60 billion annually, with only about $15 billion recoverable by the second year through diversification. At the sectoral level, textiles and apparel face a widening competitiveness gap in the U.S., benefiting Bangladesh and Vietnam, and gems and jewellery exports, valued at $11.9 billion, are at near-standstill risk. Additionally, shrimp exports suffer heavy losses in Andhra Pradesh, Bengal, and Odisha, while chemicals, auto components, and rice experience steady decline. Regarding U.S. domestic costs, the Yale Budget Lab notes that tariffs lead to higher consumer prices and job losses. Therefore, India’s leverage lies in highlighting the cost of tariffs to American voters and retailers.

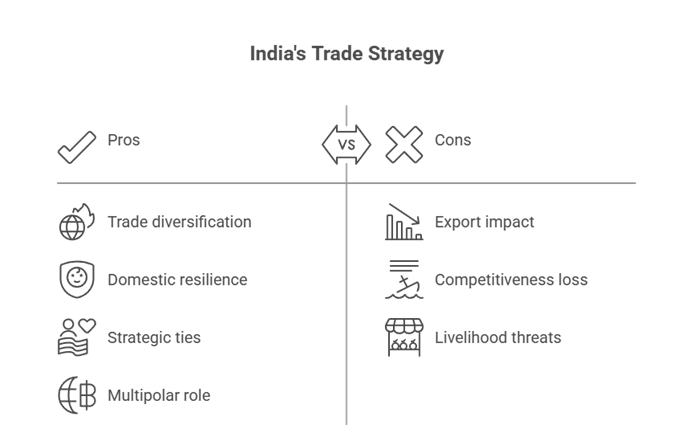

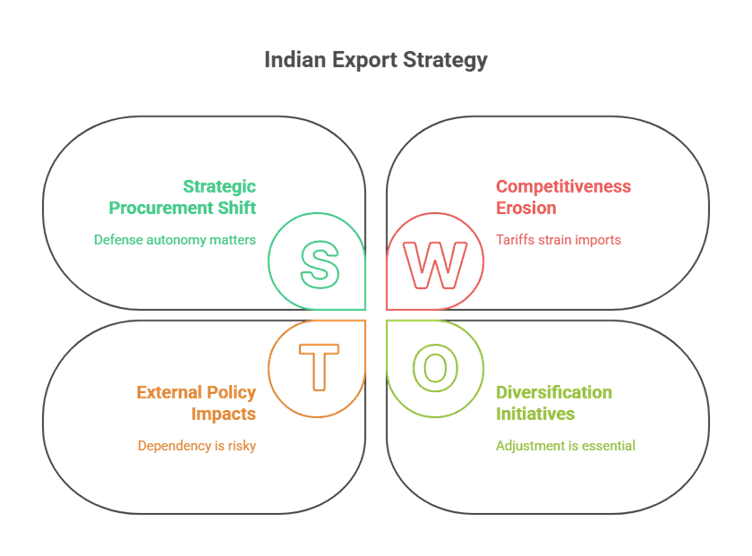

4. Strategic Response Framework

Smart U.S. re-engagement involves tactical agriculture concessions, such as GM corn imports for ethanol and tariff quotas in dairy. Additionally, targeted relief measures include subsidies and export rebates for distressed industries, alongside efforts to boost domestic consumption. At the same time, diversification strategies focus on accelerating FTAs with the UK, EU, ASEAN, and CPTPP, while also targeting growth markets in Africa and Latin America. Furthermore, structural reforms aim to upgrade infrastructure, logistics, and R&D, marking a “1991-scale modernization.” Finally, public diplomacy efforts seek to amplify the narrative of the cost impact on U.S. consumers.

5. Geopolitical Dimensions

Tariffs are viewed as economic coercion intended to alter India’s foreign policy, a move firmly rejected by New Delhi. Furthermore, strain within the Quad raises the risk of friction that could stall defense procurements and coordination. In addition, China’s preferential treatment deepens mistrust, while possible India–China trade corridors in rare earths and pharmaceuticals are being explored. Consequently, India’s pivot toward the BRICS and Non-Western bloc is reinforced.

6. Tabular Representation

A tabular representation of impact of tariff on India is shown below and its projected impact, key sectors affeceted.

Table 1: Impact of Tariff Increase (from 25% to 50%)

| Aspect | Details | Projected Impact | Key Sectors Affected | Notes |

|---|---|---|---|---|

| Tariff Level | Raised to 50% from 25% (August 2025) | Significant increase in import costs | Textiles, apparel, gems, jewelry, auto parts, organic chemicals, industrial goods | 50% tariff heavily impacts labor-intensive sectors |

| Export Value at Risk | Approximately $48–61 billion worth of exports | Large drop in Indian exports to U.S. market | Labor-intensive and intermediate goods sectors | Shrimp and carpets face tariffs above 50% |

| GDP Impact | Potential 0.2% to 0.5% reduction in India’s GDP | Slowed economic growth | Whole economy affected indirectly | S&P sees limited long-term macroeconomic effect |

| Market Competitiveness | Loss of cost advantage | US market share loss to Vietnam, Bangladesh | Export competitiveness declines in affected sectors | Rise in global competition |

| Trade Negotiations | Bilateral Trade Agreement talks stalled | Delay in achieving long-term trade goals | Overall trade target of $500B at risk | Uncertainty delays investments |

| Financial Markets | Rupee depreciation, inflation risk | Negative short-term currency and stock market impact | Increased volatility | Increased risk perception |

Table 2: Impact of Tariff Decrease or Suspension (Return to ≤25% or Removal)

The table showcases how reducing or suspending Trump’s tariffs to 25% or lower can positively influence India-U.S. bilateral trade. Lower tariffs decrease the cost burden on Indian exporters, making their products more competitively priced in the U.S. market. This tariff relief enables previously affected sectors like textiles, apparel, and other labor-intensive industries to regain their market share and export volumes.

| Aspect | Details | Projected Impact | Key Sectors Benefited | Notes |

|---|---|---|---|---|

| Tariff Level | Reduced back to 25% or suspended | Cost reduction for Indian exports | Labor-intensive sectors regain price edge | Trade competitiveness restored |

| Export Recovery | Recovery of exports stalled by high tariffs | Exports gradually return to pre-tariff levels | Same sectors seeing decline benefit | Potential rebound in annual growth rates |

| GDP Impact | Mitigated negative growth impact | GDP growth stabilizes or improves | Economy-wide positive effect | Boost to manufacturing and export sectors |

| Trade Deal Progress | Resumption of BTA trade talks | Enhanced bilateral cooperation and investment | Increased trade flows across sectors | Positive market and policy environment |

| Currency and Markets | Rupee stabilizes, market confidence improves | Reduced volatility and inflationary pressures | Positive investor sentiment | Improved capital inflows |

Table 3: Sector-Specific Tariff Impact Comparison

A sector-wise comparison of the impact of Trump’s tariffs on India-U.S. bilateral trade under two scenarios: a tariff increase to 50% and a tariff decrease or suspension back to 25% or lower.

| Sector | Impact Under 50% Tariff Increase | Impact When Tariff Reduced/Suspended | Examples | Notes |

|---|---|---|---|---|

| Textiles & Apparel | Large export losses, market share erosion | Recovery in exports & competitiveness | Cotton garments, fabrics | Labor intensive sector |

| Gems & Jewelry | Export volume contraction | Recovery in export orders | Diamonds, precious stones | Significant U.S. market dependence |

| Automotive Parts | Higher costs reduce exports | Market regeneration and growth | Auto components, vehicle parts | Intermediate goods affected |

| Pharmaceuticals | Largely exempt, minimal direct tariff impact | Continued export growth | Generic drugs, APIs | Major Indian export sector to U.S. |

| Electronics | Exempt or minimal impact | Steady or growing exports | Components and devices | Strategic sector; critical for talks |

| Agriculture | Certain products face high effective tariffs | Rebound for horticultural and organic products | Spices, nuts, shrimp | Vulnerable to tariff volatility |

7. Stakeholder Perspectives

Farmers’ unions strongly defend red lines and oppose any concessions on dairy and agriculture, while exporters face critical financial distress and demand relief. At the same time, the IT and pharmaceutical sectors experience indirect exposure to U.S. visa and regulatory barriers. Meanwhile, rising inflation impacts U.S. retailers and consumers, potentially creating policy pressure. Additionally, multinational corporations are rethinking India as an export hub but continue to operate for the domestic market. Furthermore, BRICS partners such as China, Russia, and Iran are seizing the opportunity to deepen ties with India.

8. India’s Trade and Growth Strategy: Immediate to Long-Term Measures

Initially, the focus is on immediate export relief and strengthening domestic demand support. In the medium term, efforts are directed toward cementing Free Trade Agreements (FTAs) with the UK, EU, and ASEAN. Furthermore, the long-term goal is to build institutional competitiveness through enhanced R&D, improved logistics, and diversification of manufacturing. Ultimately, this strategic narrative positions India as a multi-aligned and resilient power.

9. Conclusion

Trump’s tariffs represent less of an economic shock and more of a strategic test, and India holds its ground by absorbing sectoral pain and accelerating reforms and trade diversification. The U.S. remains a key partner, and despite an entrenched trust deficit, ties will endure in defense and technology, while economically, India seeks hedging through multi-alignment and self-reliance.

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/es-MX/register?ref=GJY4VW8W

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/ES_la/register-person?ref=VDVEQ78S

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.info/ur/register?ref=SZSSS70P