GST RATE RATIONALISATION

Introduction

The Goods and Services Tax (GST), introduced in India on 1st July 2017, was envisioned as a landmark reform aimed at unifying the indirect taxation system under the principle of “One Nation, One Tax, One Market.” However, despite its success in streamlining taxes and improving compliance, the presence of multiple tax slabs ranging from 0% to 28% created complexities for businesses, consumers, and policymakers alike.

Therefore, the idea of GST rate rationalisation has gained prominence in recent years. It essentially refers to restructuring and simplifying the GST framework by reducing the number of tax slabs, aligning rates with revenue considerations, and ensuring fairness across sectors. Moreover, rationalisation aims to minimise classification disputes and ease the compliance burden, which, in turn, enhances transparency in taxation.

In addition, the process helps resolve the problem of inverted duty structures, where inputs are taxed at higher rates than finished goods, thereby discouraging manufacturing. Consequently, rationalisation not only promotes efficiency in the tax system but also boosts consumption by making goods and services more affordable.

Thus, GST rate rationalisation stands at the intersection of equity, efficiency, and simplicity. As discussions around GST 2.0 intensify, rationalisation has emerged as a central reform measure that could shape the future of India’s indirect tax regime.

Brief History & Key Details of GST 1.0 (India)

1. Origins and Early Discussion

- The concept of GST was first proposed around the year 2000 by the Atal Bihari Vajpayee government, which formed an Empowered Committee of State Finance Ministers to design a roadmap for a unified tax system.

- In 2004, the Kelkar Task Force on Fiscal Responsibility recommended adopting GST to resolve the prevailing fragmented and cascading indirect tax.

2. Legislative Journey

The initial 115th Constitutional Amendment Bill was introduced in 2011 but lapsed. It was reintroduced in 2014 as the 122nd Amendment Bill under the NDA government.

ClearTaxTaxGuru

• Both Houses of Parliament passed the Bill in 2016, paving the way for the Constitution (One Hundred and First Amendment) Act, 2016, which legally enabled GST.

3. Implementation

- GST officially became effective on 1 July 2017, marking the launch of GST 1.0 under the landmark slogan “One Nation, One Tax, One Market.”

- The rollout followed intense preparations, including 18 GST Council meetings and wide-ranging stakeholder consultations.

4. Structural Framework

5. Key Features and Impacts

- Introduced the Input Tax Credit (ITC) mechanism, eliminating the cascading effect of taxes.

- Established the GST Network (GSTN), a digital platform for registration and filings.

- The GST Council, chaired by the Finance Minister of India and including state representatives, became the apex body for tax rate formulation and policy decisions.

- GST is a destination-based, multi-stage tax, assessed at each stage of production but refunded and ultimately borne by the consumer.

6. Effects

- Positives: Unified tax structure, simplified compliance, broader tax base, and improved transparency.

- Challenges: Complexity due to multiple slabs, frequent rate revisions, initial technical glitches in GSTN, and refund delays affecting exporters/MSMEs.

GST Slabs (2017, GST 1.0)

| Slab Rate | Examples of Goods/Services Included |

| 0% (Exempt) | Fresh milk, eggs, bread, curd, fresh vegetables & fruits, salt, education services, health services. |

| 5% | Soaps, toothpaste, hair oil, capital goods, industrial intermediates, financial services, telecom services, and restaurants (non-AC). |

| 12% | Packaged food items, tea, coffee, edible oil, sugar, coal, transport services (rail/road), and economy class air travel. |

| 18% | Luxury and sin goods: cars, motorcycles, ACs, refrigerators, washing machines, cement, paints, tobacco products, and pan masala. |

| 28% | Luxury and sin goods: cars, motorcycles, ACs, refrigerators, washing machines, cement, paints, tobacco products, pan masala. |

| + Cess | De-merit goods like luxury cars, aerated drinks, pan masala, cigarettes, and tobacco — cess applied in addition to 28%. |

Impact of GST 2.0 Compared with GST 1.0

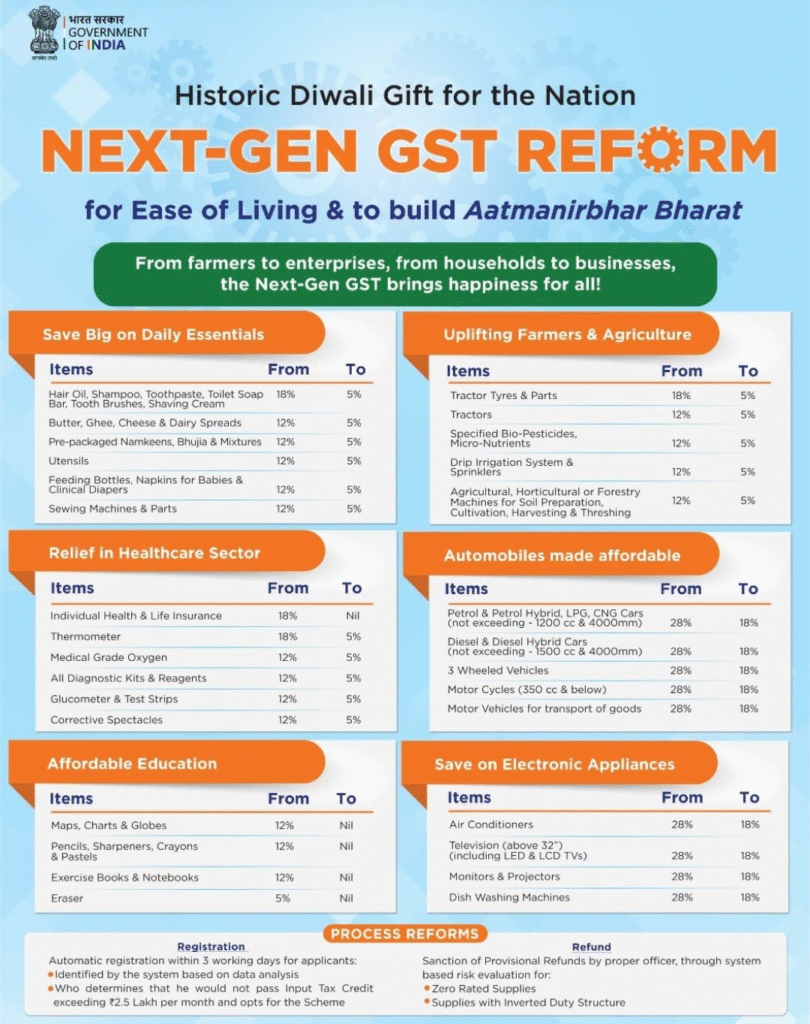

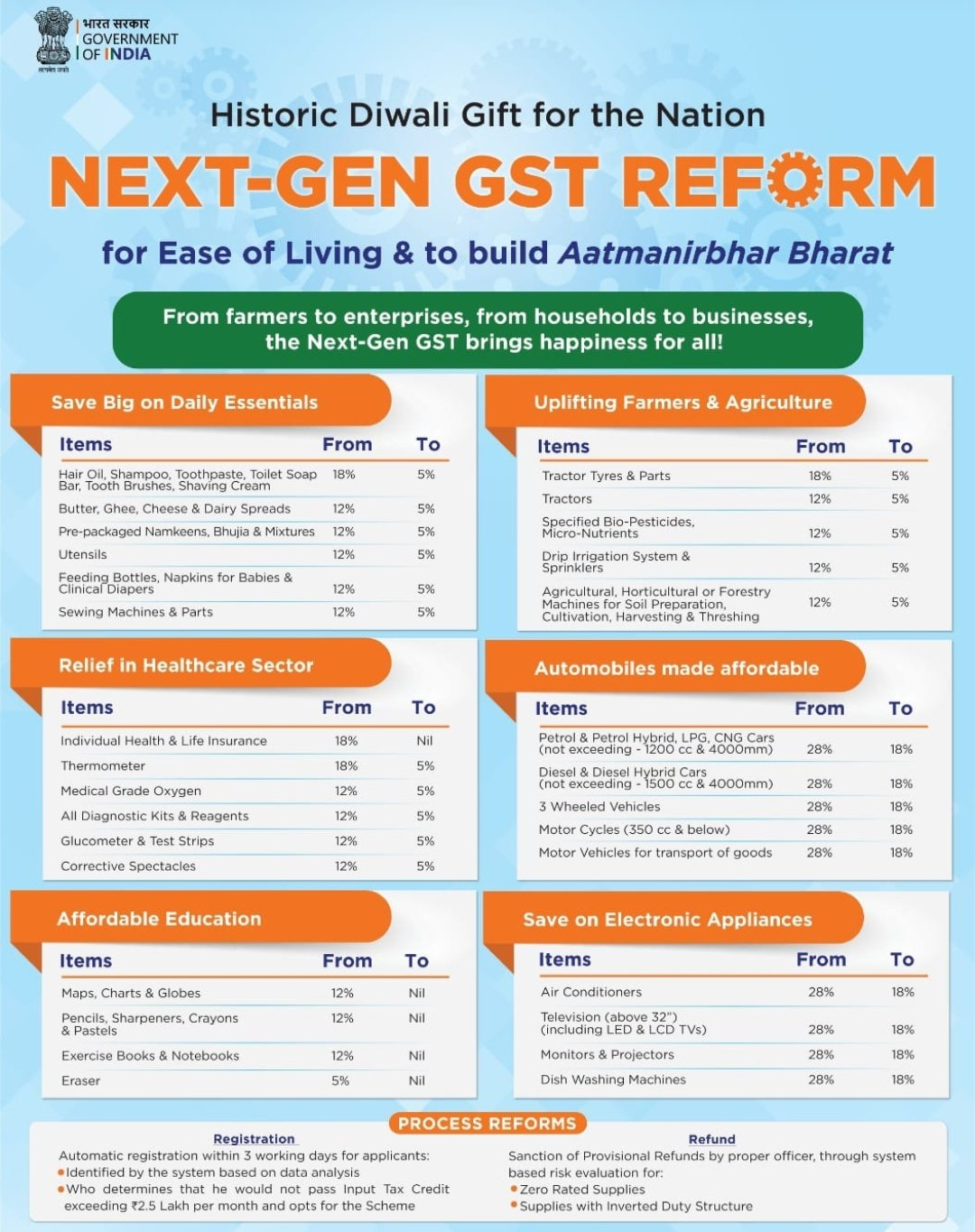

The introduction of GST 2.0 has significantly altered the way different sections of society experience taxation benefits because the government has rationalised rates and simplified compliance. Unlike GST 1.0, which imposed higher taxes on essential items and created refund delays, GST 2.0 has lowered tax burdens and improved efficiency. Therefore, both households and businesses now enjoy greater financial relief.

Students

For students, GST 1.0 made digital tools, laptops, and stationery costlier as they attracted taxes ranging from 12% to 18%. However, under GST 2.0, these rates have been reduced to between 0% and 12%, which means learning materials and e-education are now more affordable. Consequently, students, especially from middle-class families, can access education at a lower cost, and digital inclusion has improved.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Stationery | 12% | 0–5% | Affordable learning essentials |

| Laptops/Computers | 18% | 12% | Digital inclusion |

| E-learning services | 18% | 12% | Cheaper online education |

➡️ Analysis: Students have gained considerably under GST 2.0 because essential items like stationery and laptops have become cheaper. Moreover, since the tax on e-learning platforms has been reduced, digital education is now more accessible. Therefore, the reform directly supports India’s vision of Digital Bharat and enhances opportunities for low- and middle-income students

Employees

Similarly, employees gain because consumer goods such as electronics and household appliances have moved from the 18–28% slab in GST 1.0 to the 12–18% slab in GST 2.0. Moreover, the GST rate on restaurants has been brought down from 18% to 5%. As a result, employees now have more disposable income, and their lifestyle expenses have reduced considerably.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Electronics & Appliances | 18–28% | 12–18% | Affordable gadgets |

| Restaurants | 18% | 5% | Eating out cheaper |

| Lifestyle Services (salons, gyms) | 18–28% | 12% | Lower lifestyle costs |

➡️ Analysis: Employees benefit because consumer durables and services have become cheaper. Since restaurants now attract only 5% GST, eating out has become affordable, and because appliances are taxed less, work-from-home setups are also more cost-effective. As a result, disposable income has increased, leading to higher consumer satisfaction.

Older People

For older people, healthcare and insurance benefits are particularly important. Under GST 1.0, medical devices were taxed at 12–18% and health insurance premiums at 18%. In contrast, GST 2.0 has reduced medical devices to 5%, life-saving drugs to 0%, and insurance premiums to 12%. Therefore, older adults not only spend less on medical care but also gain greater access to affordable insurance, which ensures financial security in old age.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Medical Devices | 12–18% | 5% | Affordable healthcare aids |

| Life-saving Drugs | 5% | 0% | Free of GST burden |

| Insurance Premiums | 18% | 12% | Lower cost of coverage |

➡️ Analysis: Elders gain significantly from GST 2.0 because the tax burden on medicines and insurance has been reduced. Furthermore, since life-saving drugs are now GST-free, the cost of treatment has fallen, and because insurance premiums are cheaper, long-term financial protection has become more accessible.

Health Sector

The health sector also benefits because equipment and medicines are cheaper. In GST 1.0, refund delays created liquidity stress for hospitals and pharma companies. However, GST 2.0 introduces a faster refund system, and in addition, medical equipment now falls under the 5% slab. Consequently, healthcare services can be delivered at a lower cost, which directly benefits patients.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Medical Equipment | 12–18% | 5% | Hospitals’ cost reduced |

| Drugs | 5% | 0% | Affordable treatment |

| Refund System | Slow, delays | 7-day automated refunds | Better liquidity |

➡️ Analysis: Hospitals and pharmaceutical companies are relieved because treatment costs have declined. Since equipment and medicines attract lower or zero tax, patients pay less, and because refunds are now automated, hospitals face fewer liquidity problems. Consequently, healthcare delivery becomes more efficient.

Insurance

When it comes to insurance, the reforms are equally impactful. Since GST 1.0 levied 18% on premiums, policies were expensive, and coverage remained limited. But now, GST 2.0 reduces premiums to 12%, and in some cases removes them altogether. Therefore, insurance has become more affordable, which will likely increase penetration in rural and urban areas alike.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Premiums | 18% | 12% (or exempt for some) | Wider coverage |

➡️ Analysis: Insurance has become more affordable under GST 2.0 because the tax on premiums has been reduced from 18% to 12%. Moreover, certain social insurance schemes are fully exempt, and therefore, vulnerable groups get better protection. As a result, insurance penetration is likely to increase, while citizens enjoy stronger financial security.

Women

Women also experience positive changes because personal hygiene products and cosmetics are cheaper. For instance, sanitary napkins, which earlier attracted 12% GST, are now completely exempt. Furthermore, the GST on personal care products has fallen from 18% to 12%. As a result, women’s essential and hygiene-related expenses have reduced significantly.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Sanitary Napkins | 12% | 0% | Affordable hygiene |

| Cosmetics/Personal Care | 18% | 12% | Cheaper essentials |

➡️ Analysis: Women benefit significantly under GST 2.0 because sanitary napkins are now completely tax-free. In contrast, they attracted a 12% tax under GST 1.0, which made them relatively expensive. Moreover, personal care products are taxed at lower rates, and therefore, women’s essential expenses are reduced. As a result, this reform supports both gender equality and women’s health.

Agriculture Sector

The agriculture sector is another key beneficiary. Farmers earlier had to pay 12% on fertilisers and 18% on farm tools under GST 1.0. However, in GST 2.0, these items now attract only 5%. Consequently, input costs have declined, and therefore, farmers can increase productivity without additional financial burden.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Fertilizers | 12% | 5% | Lower input costs |

| Tractors/Tools | 18% | 12% | Cheaper farm equipment |

➡️ Analysis: Farmers gain under GST 2.0 because agricultural inputs are now cheaper. While fertilisers are taxed at 5% instead of 12%, tractors and farm tools are taxed at 12% instead of 18%. Consequently, input costs for farming are reduced, and therefore, farmers can improve productivity at a lower cost. Moreover, this also supports rural incomes and food security.

Startups and MSMEs

Startups and MSMEs have also gained because GST 1.0 created compliance challenges such as multiple return filings and ITC mismatches. On the other hand, GST 2.0 simplifies procedures through quarterly returns and automated refunds. Moreover, service tax rates have fallen from 18% to 12–15%, which reduces costs for technology-driven and service-based businesses. Hence, entrepreneurs find it easier to grow in the new tax regime.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Return Filings | Monthly, complex | Quarterly, simplified | Compliance ease |

| Refunds | Delayed | Automated 7-day | Better cash flow |

| Services Tax | 18% | 12–15% | Lower costs |

➡️ Analysis: MSMEs and startups are the biggest winners of GST 2.0 because compliance has been simplified. While GST 1.0 required monthly filings, GST 2.0 allows quarterly returns, and therefore reduces paperwork. Moreover, refunds are now automated within 7 days, which improves cash flow. As a result, small businesses gain financial stability, while entrepreneurship and innovation are encouraged.

Exporters

Exporters also benefit because GST 1.0 caused refund delays, which blocked working capital. However, GST 2.0 has introduced an automated seven-day refund window. In addition, textiles and handicrafts now fall under lower slabs. Therefore, exporters enjoy improved liquidity and become more competitive in global markets.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Refunds | Months of delay | 7-day refunds | Improved liquidity |

| Textile & Handicrafts | Higher tax slabs | Lower slabs | Global competitiveness |

➡️ Analysis: Exporters benefit greatly under GST 2.0 because refund delays have been cut down. Earlier, exporters faced liquidity stress as refunds took months, but now automated refunds ensure timely payments. Moreover, lower taxes on textiles and handicrafts make Indian products more competitive globally. Therefore, exporters enjoy both financial relief and enhanced market reach.

the green economy

Finally, the green economy has been promoted. Renewable energy equipment, such as solar panels and wind turbines, was taxed at 12–18% under GST 1.0. Yet, under GST 2.0, they fall under the 5% slab. This not only makes renewable energy cheaper but also encourages sustainable development and supports India’s climate goals.

| Aspect | GST 1.0 | GST 2.0 | Benefit |

| Solar/Wind Equipment | 12–18% | 5% | Affordable renewable adoption |

➡️ Analysis: GST 2.0 strongly supports the green economy because renewable energy equipment now attracts only 5% GST. In contrast, GST 1.0 imposed rates as high as 18%, which made solar and wind projects costlier. Therefore, renewable adoption becomes more affordable, while India’s climate goals receive a significant boost.

By lowering tax rates and introducing refund automation, GST 2.0 reduces costs for students, employees, elders, farmers, and businesses. Because it shifts focus from revenue maximisation to affordability and growth, it strengthens both household savings and India’s economic competitiveness.

Table: Average Consumer Savings under GST 2.0 vs GST 1.0

| Category | Estimated Average Savings (%) |

| Daily Essentials | 10% |

| Food & Grocery | 7% |

| Healthcare & Insurance | 12% |

| Education Supplies | 12% |

| Agriculture Inputs | 10% |

| Housing & Construction | 10% |

| Automobiles | 12% |

| Electronics & Appliances | 10% |

| Textiles & Footwear | 7% |

| Green Energy Equipment | 7% |

| Services (Hotels, Cinema, Beauty) | 10% |

Impact of GST 2.0 on the Economy and Consumers

The introduction of GST 2.0 in 2025 is expected to positively influence India’s GDP by boosting consumption, improving compliance, and reducing tax complexity. According to SBI Research, GST 2.0 could add nearly ₹1.98 lakh crore (~0.6% of GDP) directly through higher household consumption. Moreover, when combined with income-tax relief measures, the total potential boost may reach ₹5.31 lakh crore (~1.6% of GDP). Although the government may face a short-term revenue loss of 0.2–0.4% of GDP, the long-term gains from enhanced compliance, wider tax base, and improved ease of doing business are expected to outweigh these losses. Consequently, GST 2.0 has the potential to increase India’s GDP growth by 0.5–1.2% annually in the medium term.

| Aspect | Estimated Impact | |

| Consumption Boost | ₹1.98 lakh crore (~0.6% of GDP) | |

| Combined Fiscal Stimulus | ₹5.31 lakh crore (~1.6% of GDP) | |

| Short-term Revenue Loss | ₹60,000–1,10,000 crore (0.2–0.4% of GDP) | |

| Medium-term GDP Growth Boost | 0.5–1.2% per year |

Short-Term Effects

Consumers:

GDP:

- Analysts expect a 100–120 basis point (1–1.2%) boost in GDP growth over the next 4–6 quarters due to increased consumption.

- Bank of Baroda projects that GST rate cuts alone could add 0.2–0.3 percentage points to GDP in FY2025–26, with stronger effects anticipated in FY2026–27.

Long-Term Effects

Consumers:

- Sustained lower prices and improved affordability can increase access to essential services like healthcare and insurance, especially among the middle and lower-income segments.

- Over time, consumers benefit from clearer billing and reduced classification disputes, enhancing transparency and overall welfare.

GDP:

- In the long run, GST 2.0 is expected to widen the tax base, encourage formalisation, and support greater compliance—all contributing to more resilient and sustainable GDP growth.

- SBI Research estimates the combined impact of GST rate rationalisation and income-tax relief could unlock ₹5.31 lakh crore in additional consumption (≈1.6% of GDP), while GST alone contributes ₹1.98 lakh crore.

Comparative Snapshot

| Aspect | Short-Term Impact | Long-Term Impact |

| Consumers | Immediate price reductions on essentials | Sustained affordability, better access to services |

| GDP Growth | +0.2–1.2% boost from consumption surge | Higher base growth driven by formalisation and increased tax base |

Impact of GST 2.0 on Government Revenue

GST 2.0 is projected to create a short-term revenue loss for the government but aims to boost consumption, which may compensate for fiscal gaps; the direct revenue impact is estimated at ₹48,000–85,000 crore annually, with higher-end goods enduring a 40% slab to offset part of the loss, and the broader stimulus expected to support aggregate demand and potentially keep the government’s kitty stable over time.

Short-Term Impact on the Government Kitty

- The government expects an immediate revenue loss of approximately ₹48,000 crore per year due to the rate rationalisation and GST cuts, with independent estimates suggesting the number may reach ₹85,000 crore depending on how widely the revised slabs are implemented.

- This loss comes from lowering GST rates on essentials, mass-market goods, and exempting more basic food and healthcare items.

Counterbalancing Measures

- A new 40% GST slab for luxury and sin goods (like high-end vehicles, aerated beverages) is meant to offset some lost revenue, recouping up to ₹45,000 crore.

- The GST Council expects increased consumption and improved compliance to help plug fiscal gaps, with higher household spending stimulated by lower prices for daily essentials and income tax cuts forming a “combined stimulus”.

Medium-Term Effects

- Lower rates have already led to a projected boost in consumption and aggregate demand of around ₹1.98–5.31 lakh crore, amounting to roughly 1.6% of GDP; this multiplier effect can replenish the “government kitty” through expanded tax base and increased demand.

- Fiscal deficit impact is expected to be minimal or non-existent as offsetting measures and compensation cess adjustments are implemented.

Conclusion

GST 2.0, by rationalising rates and simplifying compliance, is expected to cause a short-term government revenue loss (₹48,000–85,000 crore annually), but this is counterbalanced by measures such as a 40% slab on luxury goods and faster refunds. Over the medium term, increased consumption, a broader tax base, and improved compliance are projected to replenish the government kitty, with minimal or negligible impact on the fiscal deficit and potential gains in household welfare and GDP growth.

The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over…

Economics of Rare Earth Metals

Rare earth elements and critical minerals are vital for clean energy and technology. They form…

Indian Rupee Depreciation Against the US Dollar

Introduction In recent years, the Indian Rupee has undergone significant depreciation against the US Dollar,…

Green Economy: Can India Balance Growth with Climate Goals?

India stands at a crucial point in history. As the world’s most populous nation and…

“Understanding ‘67’: The Viral Gen Alpha Slang That Became Word of the Year 2025”

Source – The Economic Times Every year, Dictionary.com selects a term that captures the spirit…

BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving…

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/pt-PT/register-person?ref=KDN7HDOR

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/tr/register-person?ref=MST5ZREF

Can you be more specific about the content of your enticle? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/zh-TC/register?ref=DCKLL1YD

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/ES_la/register?ref=VDVEQ78S

phontechm