GST 2.0 – Balancing Growth and Fiscal Prudence

Introduction

India’s Goods and Services Tax (GST) was introduced in 2017 as a historic reform to

replace a complex web of indirect taxes with a unified, destination-based tax system. Over

time, GST improved transparency, boosted compliance, and enhanced ease of doing

business, but also faced challenges like multiple rates, inverted duty structures, and

compliance burdens. The GST 2.0 reform package marks the most ambitious overhaul of

the system since its launch, introducing a simplified rate structure, sectoral relief, and

institutional reforms designed to balance economic growth with fiscal prudence.

What is the Goods and Services Tax (GST)?

Introduced by the 101st Constitutional Amendment Act, 2017, GST is a comprehensive

indirect tax levied on the supply of goods and services in India. It replaced excise duty,

service tax, VAT, octroi, and several other indirect levies, creating a common national

market. The Kelkar Task Force (2006) laid the intellectual foundation for GST by

recommending a value-added tax system.

Key Features of GST

| Feature | Details |

| Dual Structure | CGST & SGST for intra-state; IGST for inter-state transactions |

| GST Council | Policymaking body under Article 279A |

| GSTN | Technology backbone for filing, payments, compliance |

| Threshold Exemption | Technology backbone for filing, payments, and compliance |

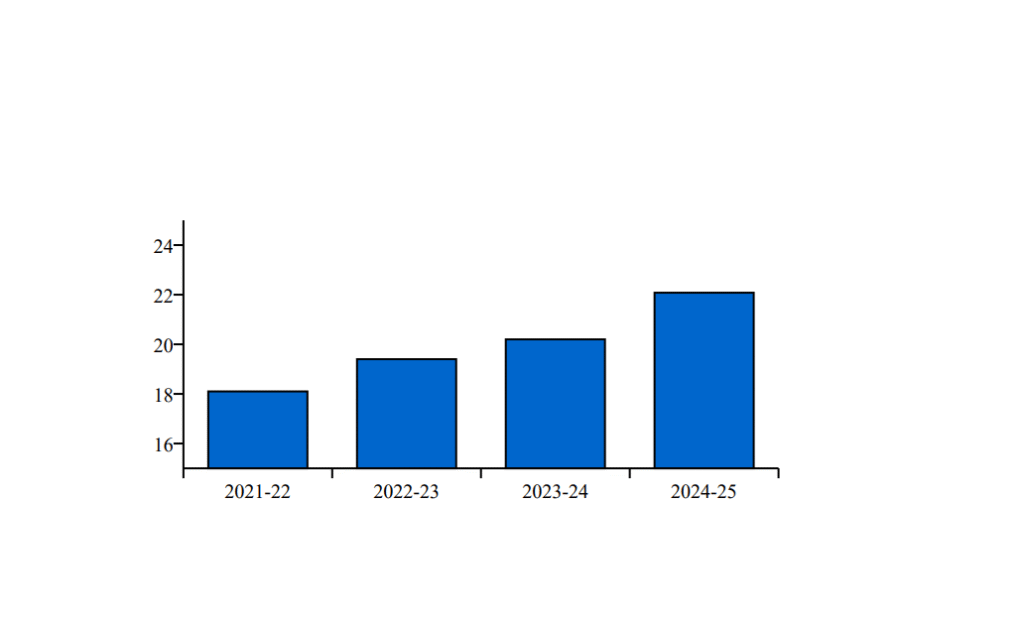

GST Collection Growth

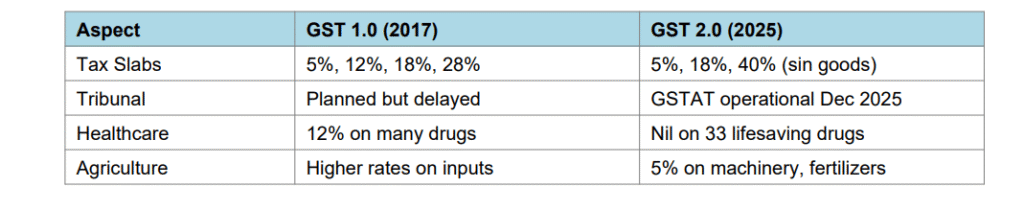

Comparison: GST 1.0 vs GST 2.0

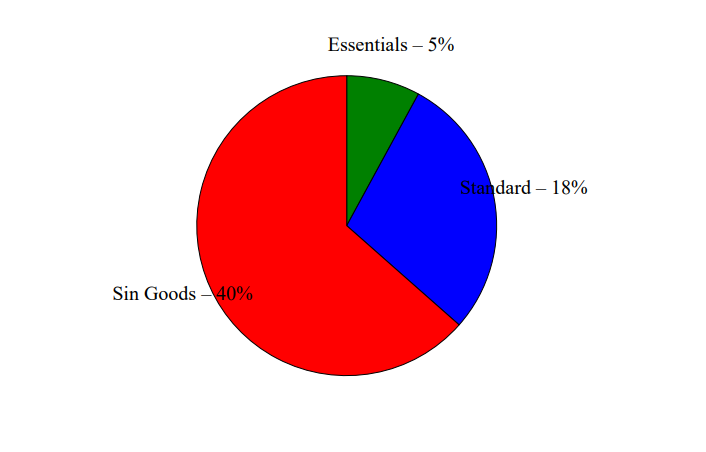

GST 2.0 Rate Structure

Key Issues with GST 2.0

Despite simplification, challenges persist:

- Cascading tax risks due to ITC restrictions.

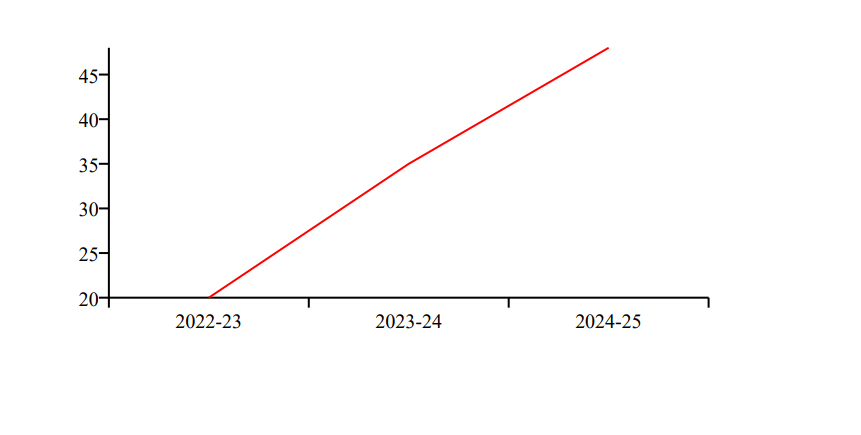

- Revenue shortfall of ~48,000 crore annually.

- Classification disputes in the reduced slab system.

- Compliance complexity for MSMEs.

- Delay in GSTAT benches in many states

Estimated Fiscal Shortfall

Conclusion

GST 2.0 represents a transformative leap in India’s taxation framework. It simplifies

compliance, lowers tax burden, and strengthens growth drivers like MSMEs, agriculture,

and healthcare. However, fiscal prudence remains crucial as revenue shortfalls may stress

state finances. A strong ITC mechanism, timely GSTAT functioning, and alignment with

long-term growth goals are essential for success. GST 2.0, if implemented with stability

and cooperative federalism, can lay the foundation for inclusive prosperity and global

competitiveness.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.info/register?ref=IHJUI7TF

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/register?ref=IXBIAFVY

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/kz/register-person?ref=K8NFKJBQ

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/da-DK/register-person?ref=V3MG69RO

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/da-DK/register?ref=V3MG69RO

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/sk/register?ref=WKAGBF7Y