BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving into a larger “BRICS+” coalition of emerging economies. In 2025, the group officially added Indonesia and invited new members, including Saudi Arabia, the UAE, Iran, Egypt, Ethiopia, and others. Combined, these nations make up about 46% of the world’s population and over a third of global GDP (at PPP). With the new members, BRICS+ now accounts for nearly half of the world’s oil production and significant mineral and agricultural resources. Leaders of BRICS+ discuss “de-dollarisation.” They promote trade and loans in local currencies, build alternative payment systems, and even debate a common currency to reduce dependence on the U.S. dollar.

This plan appears ambitious; expanding BRICS has created an economic bloc roughly the size of the G7. However, analysts caution that while BRICS+ is gaining influence, its internal divisions and the dollar’s strong global presence mean any challenge to the dollar will take time.

Why the U.S. Dollar Remains Dominant

The U.S. dollar’s dominance comes from decades of economic, financial, and geopolitical factors. The United States has the largest economy in the world and the deepest, most liquid capital markets, which provide a vast supply of safe, dollar-denominated assets. U.S. institutions, such as the Federal Reserve and Treasury, are widely trusted. The rule of law and stable property rights give investors more confidence. As a result, central banks held about 58% of global foreign exchange reserves in dollars in 2024, far exceeding any other currency. In comparison, the euro held around 20% of reserves, and the Chinese renminbi had only about 2%.

Network effects also reinforce the use of the dollar. Most global commodities, especially oil, are still priced in dollars, and dollar-clearing is key in international finance. In practice, 80-90% of international trade transactions are invoiced or settled in USD. Even when trade uses a local currency, parties often use dollars for trades because dollar exchange markets are much deeper and more liquid. This self-reinforcing cycle, sometimes called the dollar’s “exorbitant privilege,” makes it very hard to replace. No other currency or combination of currencies matches the scale, liquidity, and trust of the dollar system. In short, the USD remains dominant because the U.S. created the modern financial system, and its economy and capital markets still outweigh those of any competitor.

Why Emerging Economies Seek Alternatives

Many emerging nations, including BRICS members, aim to reduce reliance on the dollar due to risks like U.S. sanctions and its weaponisation, exemplified by measures against Russia and Iran. U.S. monetary policy, with quantitative easing and tightening, and a strong dollar, has also increased debt servicing costs for developing countries, prompting them to seek alternative currencies for loans.

Many Global South leaders, including UN Secretary-General Guterres, criticise the U.S.-dominated global finance system (Bretton Woods), calling it beneficial only to rich nations. BRICS+ nations advocate for “greater representation” and a more equitable, multipolar financial system. They are increasing South-South cooperation and direct, non-dollar transactions (e.g., China/Russia using yuan/rubles, India/UAE/Russia using rupees) to mitigate dollar risk. BRICS+ also invests in their own institutions, like the New Development Bank, operating on their terms.

The 2025 BRICS+ Expansion: Members and Ambitions

BRICS expanded significantly from 2023 to 2025. Following the 2023 Kazan summit, Russia invited six new members: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE. Though Argentina declined and Saudi Arabia postponed, the others joined. Indonesia became the tenth full member in January 2025. A new “partner country” tier was established for non-voting nations like Malaysia, Turkey, and Nigeria. This expansion, forming BRICS+, gives the bloc a global footprint across the Middle East, South Asia, Southeast Asia, Africa, Eurasia, and Latin America.

The expanded BRICS+ bloc holds significant global economic power, representing 46% of the world’s population and over 36% of global GDP (PPP). New members like Saudi Arabia, UAE, and Iran boost oil exports, potentially giving BRICS+ control of 30-50% of global oil output and half of commodities trading. With over $5.2 trillion in reserves and strong agricultural and mineral resources, BRICS+ is a major global force.

BRICS+ has increased its influence by establishing the New Development Bank (NDB) and Contingent Reserve Arrangement (CRA) as alternatives to the World Bank and IMF, though the NDB is smaller. Its expansion enhances diplomatic power, supporting UN reform, debt relief, and Global South goals. Through cooperation across working groups, BRICS+ advocates for a multipolar world order.

| Category | Country | Accession Date | Key Strategic Status |

| Founding Members | Brazil, Russia, India, China, South Africa | 2006-2010 | Original BRICS-5 members. |

| 2024 Expansion (Full Members) | Egypt, Ethiopia, Iran, United Arab Emirates (UAE) | Jan 1, 2024 | Invited to join Jan 1, 2024, but as of July 2025, is “still considering the matter”.Did not formally join and declined to attend the 2024 summit. This is a deliberate “hedging” strategy |

| 2025 Expansion (Full Member) | Indonesia | Jan 6, 2025 | First Southeast Asian member. |

| Ambiguous / Invited (Not Joined) | Saudi Arabia | Invited 2023 | Invited to join Jan 1, 2024, but as of July 2025 is “still considering the matter”.Did not formally join and declined to attend the 2024 summit. This is a deliberate “hedging” strategy |

| 2024/2025 Partner Countries | Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, Uzbekistan, (and others) | 2024 | First expansion, effective at the 2024 Kazan Summit. |

Financial Initiatives and De-Dollarisation Efforts

BRICS nations are actively working to reduce reliance on the US dollar, focusing on local currency trade and new payment systems. They support expanding local currency financing through the NDB and encourage central banks to explore swap lines and CBDC integration. By 2024, 65% of BRICS+ trade was settled in local currencies, with Russia conducting 90% of its BRICS trade outside the dollar. Notable agreements include China and Russia’s $245 billion trade in yuan and rubles, and India’s expanded rupee trade with Russia and the UAE, all aimed at reducing conversion risk and diminishing the dollar’s role.

BRICS nations are developing alternative payment networks like “BRICS Pay” or the BRICS Cross-Border Payments Initiative (BCBPI). This blockchain-based system, connecting national payment platforms such as China’s CIPS and UnionPay, Russia’s SPFS, India’s UPI, and Brazil’s PIX, will enable direct payments in national currencies, bypassing SWIFT and U.S. banks. A “BRICS Bridge” will facilitate this. Pilot versions are active, with full operation expected by 2030. The platform will also support central bank digital currencies.

Despite discussions, a common BRICS currency, or even a crypto option, remains unlikely. Experts emphasise the lack of necessary political and fiscal integration among member states, making a true BRICS currency far from reality. With the dollar dominating over 80% of trade, and India rejecting the idea, a new BRICS reserve currency is doubted for its stability and reliability.

BRICS nations are pursuing a gradual shift away from the dollar by expanding swap lines, fostering cross-border banking, and promoting settlements in local currency pairs like yuan-rupee or ruble-rupee. The NDB supports this by offering more local currency loans. The goal is to build a parallel financial infrastructure for trade and finance without immediate dollar overthrow.

Impact on Global Trade and Oil Markets

An expanded BRICS could reshape certain markets, with oil being a prime example. By including major exporters like Saudi Arabia, the UAE, Iran, and Russia, BRICS+ would control roughly 30 to 50% of global oil output. In theory, these countries could choose to price and trade more of their oil in currencies other than the US dollar. For instance, China has already agreed to buy some Russian oil in yuan, and India’s largest refiner has received permission to pay for Iranian oil in rupees. If these changes happen quickly, they could weaken the petrodollar’s dominant role. An analysis from the World Economic Forum states that with Saudi Arabia joining, BRICS would become a major force in commodities. At the Rio 2025 summit, leaders expressed interest in conducting oil and energy deals in local currencies, like yuan or rupees, whenever possible.

BRICS+ nations, major commodity consumers and raw material suppliers, could gradually reduce dollar reliance through trade policy collaboration, like rerouting G7 exports or using currency swaps. However, global trade’s interconnectedness means China and India can’t fully avoid dollar transactions or global price benchmarks short term. The immediate effect is increased bilateral trade (e.g., yuan/rupee energy sales), boosting emerging market currency liquidity and lowering USD demand in some commodity deals. Despite this, Western countries remain top trading partners for China and India, and intra-BRICS trade is still small.

BRICS’ expansion boosts its influence on commodities and trade, allowing it to represent the Global South’s interests in food, energy, and development. However, immediate shifts in oil markets are unlikely as producers like Saudi Arabia remain cautious about abandoning dollar-based contracts due to the dollar’s global market presence. A credible alternative, such as widely accepted yuan-pegged oil futures or fully convertible rubles or riyals, is a long-term goal for different oil pricing.

BRICS+ Strengths: Size, Resources and Unity

The strengths of BRICS+ come from its large size and resource base. Its members include three of the five largest economies in the world: China, India, and potentially Indonesia or Saudi Arabia in the future. It also includes two of the biggest populations. With over 3.3 billion people, nearly half of the world’s population, BRICS+ has a vast labour force of 1.5 billion workers. The group’s nominal GDP is already comparable to the U.S. when adjusted for purchasing power, totalling over $27 trillion combined. The foreign reserves of BRICS+ exceed $5 trillion, giving it resources to stabilise currencies if necessary. Many members, especially India and some Middle Eastern nations, have high growth rates, so their relative economic strength continues to rise.

RESOURCES

In terms of resources, BRICS+ is self-sufficient in several key areas. It produces a significant portion of the world’s commodities, including about 42% of global steel, 45% of farmland exports, and large amounts of oil, gas, and minerals. This production gives it leverage on issues like climate policy, trade rules, and development finance. Institutions such as the NDB, when expanded, could fund projects similar to the Belt and Road Initiative across the Global South. This could reduce Western control over infrastructure funding.

OIL RICH MEMBERS

Oil-rich nations are key to reducing dollar reliance. Their inclusion in BRICS boosts the bloc’s influence, allowing countries like Saudi Arabia and Russia to negotiate better oil prices and currency terms. UAE’s financial hubs like Dubai and Abu Dhabi already support multi-currency trade finance and payment links (e.g., with China’s Silk Road, promoting rupees and yuan), potentially facilitating banking tech transfer and amplifying BRICS’ financial initiatives.

COORDINATION

BRICS+ operates by consensus, allowing members to retain sovereignty. This flexibility prevents easy exclusion of core members like China, India, and Russia; for example, Russia remained in BRICS after the 2022 Ukraine invasion due to other members’ choices. This consensus helps BRICS+ address geopolitical issues and set broad goals, such as joint resolutions on IMF and World Bank reform, without strict EU-like commitments.

BRICS+ Weaknesses and Internal Divisions

Heterogeneity of Member States

Despite its growth, BRICS+ has a significant weakness in its internal diversity. The member countries vary greatly in their political systems, economic models, and strategic goals. India and China, the two largest members, are long-standing rivals and have even clashed along their border. Both compete for influence in Asia and Africa, following different approaches: India’s “multi-alignment” and China’s assertiveness. Similarly, Saudi Arabia and Iran, traditional enemies with opposing regional alliances, now exist uneasily within BRICS+. Even though leaders try to set aside these rivalries, history shows that these tensions can easily rise again in joint forums.

Diverging National Interests

Beyond political rivalry, BRICS+ members also have conflicting economic goals. South Africa and Brazil face weak growth and still depend on Western export markets and capital. In contrast, Russia and Iran, facing heavy Western sanctions, focus on creating alternative trade and financial systems to avoid the West. These differences make it difficult to coordinate policies within BRICS+, often leading to superficial agreements.

Contrasting Political Systems

The political landscape in BRICS+ includes liberal democracies like India and authoritarian states such as China, Russia, and the UAE. This ideological variety makes deeper integration challenging, as the group has no enforcement mechanism or common governance structure. Experts point out that these differing political values hinder the creation of a unified financial or institutional system. As a result, BRICS+ tends to focus on symbolic cooperation instead of genuine policy alignment.

Financial and Currency Limitations

A major obstacle to financial integration is the weak global standing of most BRICS+ currencies. The rupee, real, and rand are much less liquid and convertible compared to the U.S. dollar or euro. While Russia and China have created alternative payment systems, most other members depend on dollar-based settlements. In practice, except for the Chinese yuan, BRICS+ currencies still go through the dollar for cross-border trade. This means that building a payment system independent of the dollar will be a long and technically complex process.

Economic Imbalances

BRICS+ members vary greatly in economic size, development levels, and overall stability. China’s economy is much larger than that of Ethiopia or even India when looking at per capita figures. These differences make ideas for a monetary or currency union very unrealistic. Even the New Development Bank (NDB), created to balance against Western-led financial institutions, is limited in size and cannot function as a lender of last resort during crises.

Dependence on Western Economies

Many member states in BRICS+ still have strong trade, investment, and strategic relationships with the West. Brazil and South Africa rely on the EU and Western capital markets. India is also strengthening its ties with the United States in defence, technology, and finance. This economic interdependence makes it neither realistic nor attractive to fully separate from the West. As a result, BRICS+ acts more like a group aiming to reform global finance instead of a clear anti-Western alliance.

Can Major Rivals Cooperate Economically?

BRICS+ faces challenges due to political rivalries among members, like India and China, and Saudi Arabia and Iran, who prioritise individual economic gains over collective integration. Despite mutual distrust, nations like India and China engage in trade while resisting initiatives like a common BRICS currency. Similarly, Egypt and Ethiopia, though at odds, joined for development funds. BRICS+ functions as a discussion forum, enabling cooperation on shared goals like IMF reform and South-South investment, even amidst bilateral disputes.

However, enforcing common policies opposed by key members is difficult. Experts believe a common currency or closely integrated payments union is unlikely due to national security concerns and the complexity of establishing necessary institutions. Therefore, BRICS+ is more viable for practical cooperation like trade and joint banks than as a tightly unified economic entity.

Prospects for a Multipolar Currency System by 2030

Some BRICS supporters envision a multipolar currency system emerging soon, potentially through initiatives like BRICS Pay, which aims to reduce US dollar dominance without relying on a single new currency. Analysts suggest a future with multiple anchor currencies, including the dollar, euro, renminbi, and possibly a BRICS basket. India favours a diverse system, but not entirely abandoning the dollar.

However, the near-term future (5-10 years) will likely see gradual shifts. By 2030, increased cross-border swaps, CBDC trials, and commodity contracts in yuan or rupee are possible. The euro might regain strength. BRICS Pay could be operational regionally, with Brazil leading its rollout.

Experts caution that the dollar’s network effect is very strong. Its international usage far exceeds the US share of global GDP or trade. Even with alternative currency growth, no other currency or combination can challenge the dollar’s short-term dominance. Changing global habits takes time. Thus, most predictions see a slow development of a multipolar system, with the dollar likely remaining dominant in reserves and large transactions through 2030. BRICS+ aims to build tools for a diverse future, not to achieve immediate currency equality.

Role of India: Balancing Interests

India plays an important and complex role in BRICS+. It is a founding member and one of the largest economies. However, it also maintains strong connections to the West, including the US, Europe, and Japan. New Delhi has been careful to follow an independent path. Regarding de-dollarisation, India has publicly stated it is not seeking to replace the USD. In mid-2025, India’s Foreign Ministry clearly said that “de-dollarisation is not part of India’s financial agenda.” Indian leaders focus on reducing trade risks, which means diversifying currency exposure, rather than pursuing an abrupt shift away from the dollar.

For instance, India has made several agreements to conduct bilateral trade in local currencies with countries like Russia, the UAE, and the Maldives to cut down on exchange risk. However, it has not supported a common BRICS currency. Prime Minister Modi and Finance Minister Das have both downplayed the idea of a shared BRICS currency, citing India’s geographic and economic differences from China and other members.

India backs BRICS expansion to boost its economic reach, particularly into the Middle East and Asia. The inclusion of major energy suppliers like the UAE and Saudi Arabia is strategically important. New Delhi supports new members with friendly ties (Indonesia, UAE, Egypt) while opposing adversarial ones (Pakistan). India presents BRICS as a unified platform for the Global South and acts as a bridge between BRICS+ and Western groups like the Quad, balancing ties with the U.S. and Europe with cooperation with China and Russia within BRICS.

India plays a dual role in BRICS+, both driving and moderating. It values BRICS for amplifying its voice in Asia, Africa, and the Middle East, but opposes initiatives that threaten its existing partnerships or financial stability. Experts believe this stance keeps BRICS a dialogue platform, not an anti-Western bloc.

BRICS+ Tomorrow: Challenge or Political Alliance?

The Core Question: Power Shift or Symbolism?

The main question about BRICS+ is whether it can actually challenge Western financial dominance or if its impact will mainly be symbolic. The answer seems mixed. The bloc’s influence is clearly growing; it now represents nearly half of the world’s population and about 35% of global GDP. With initiatives like the New Development Bank, local-currency trade mechanisms, and digital payment systems, BRICS+ has become a strong geoeconomic player. Its annual summits have restarted discussions on IMF reform, de-dollarisation, and the creation of a new reserve currency, ideas that were once seen as fringe.

Western Scepticism and Structural Barriers

Despite its increasing importance, many Western economists and policymakers still doubt that the U.S. dollar faces an immediate threat. An Atlantic Council report points out that no other system currently matches the dollar’s depth, liquidity, or capital markets. Likewise, financial experts say that BRICS+ members have too many conflicting interests to create a united economic group. Some U.S. policymakers, including former President Donald Trump, have even stated that America has the means to counter any effort to undermine the dollar.

Gradual Evolution of Global Finance

Rather than a sudden change, BRICS+ is likely to gradually reshape global finance. Over the next decade, the world could see a more diverse currency system where the Chinese renminbi and euro take on larger roles alongside the still-dominant dollar. Payment systems like BRICS Pay may manage a growing share of cross-border transactions. Meanwhile, the New Development Bank and other South-South institutions could widen their lending activities, slowly lessening dependence on Western financial structures.

BRICS+ as a Political Signal

The expansion of BRICS+ has significant political meaning. It shows that emerging economies want a bigger voice and more representation in the global financial system. Still, these nations rely a lot on the Western-led economy. Many of them continue to borrow from Western banks, issue bonds in dollars, and trade extensively with G7 countries. As a result, BRICS+ operates more like a coalition of convenience than an exclusive group. It brings together members with similar reform goals while they remain economically linked to the West.

Possible Futures for BRICS+

The future of BRICS+ could follow two different paths:

- Best-Case Scenario: By 2030, BRICS will develop strong payment networks and local currency markets. It might introduce a shared reserve asset or bond that slightly lessens reliance on the dollar. This would improve its bargaining power in global negotiations.

- Worst-Case Scenario: Internal conflicts and a lack of coordination keep BRICS+ mainly as a diplomatic forum with limited economic integration or financial strength.

In any scenario, BRICS+ will likely encourage the global financial system to become more multipolar. This could push Western institutions like the IMF and World Bank to make changes that better serve the Global South, while the U.S. tries to maintain the dollar’s importance through stability and strategic partnerships.

Conclusion

In conclusion, BRICS+ is a credible new voice, but it is not yet a full rival to Western financial dominance. It will change some aspects of the global landscape, especially in regional trade, finance to developing countries, and possibly commodity pricing. However, it does not suddenly make the dollar obsolete. The expansion of BRICS+ is an important geopolitical development, but its economic impact will depend on how effectively these diverse members can work together over time.

The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over…

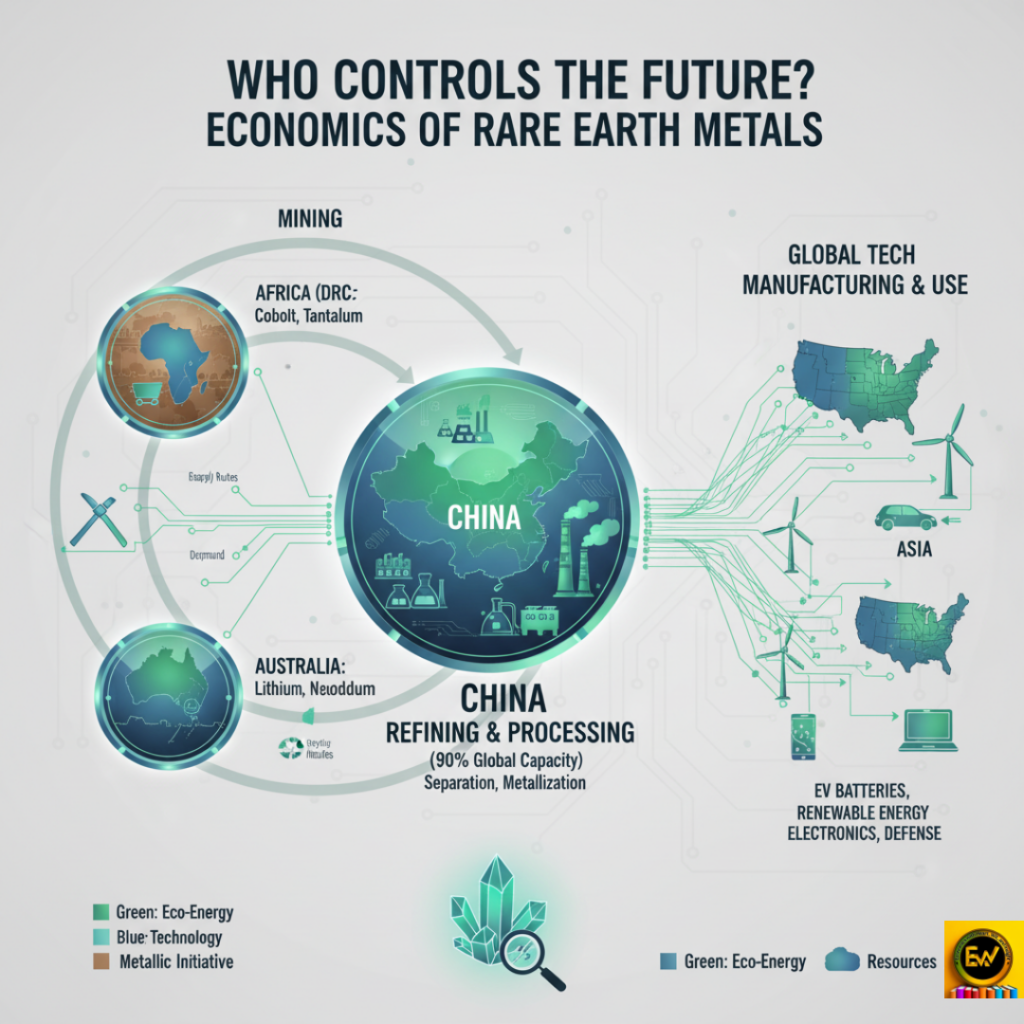

Economics of Rare Earth Metals

Rare earth elements and critical minerals are vital for clean energy and technology. They form…

Indian Rupee Depreciation Against the US Dollar

Introduction In recent years, the Indian Rupee has undergone significant depreciation against the US Dollar,…

Green Economy: Can India Balance Growth with Climate Goals?

India stands at a crucial point in history. As the world’s most populous nation and…

“Understanding ‘67’: The Viral Gen Alpha Slang That Became Word of the Year 2025”

Source – The Economic Times Every year, Dictionary.com selects a term that captures the spirit…

BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving…

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/register?ref=IXBIAFVY

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/bg/register?ref=V2H9AFPY