Crypto vs. Central Banks: The Battle for the Future of Money

The Evolution of Money: From Barter to Blockchain

Money is not just a way to trade. It is a technology of trust and a living social contract that changes with each step of human civilisation. Money is not a static object like coins or paper notes. It has always been a dynamic tool that helps societies store value, measure worth, and facilitate trade on a growing scale. The story of money is, in many ways, the story of human progress. It represents a constant search for better, scalable, and reliable ways to exchange value.

In its earliest days, economic activity was based on barter trade, where goods and services were exchanged directly for one another. While this method was simple, it was very inefficient. It needed what economists call the “double coincidence of wants.” Both parties had to want exactly what the other had at the same time. This limitation hindered trade and slowed down economic specialisation, pushing societies to look for more practical options.

This quest led to commodity money, where valuable items like livestock, salt, or grain became accepted mediums of exchange. However, the real breakthrough happened with the use of precious metals like gold and silver. Their scarcity, durability, portability, divisibility, and verifiability made them great stores of value. This sparked a huge growth in global trade, innovation, and wealth creation.

As economies expanded, carrying metal became too impractical. This led to the rise of representative money, which included paper receipts and banknotes backed by gold and silver reserves. Here, trust shifted from the inherent value of metals to the reputation of institutions. Eventually, in the 20th century, countries began using fiat money. This type of currency was not backed by gold but by government orders. While this gave central banks powerful tools to manage economies, it also brought the risk of inflation and devaluation.

Today, money is undergoing its most significant transformation yet. With cryptocurrencies and central bank digital currencies (CBDCs) reshaping the foundations of finance, we are at a historic crossroads. The conversation is no longer just about efficiency or convenience. It is about trust, freedom, and the future of value itself.

The Fortress of Central Banking: Pillars of Monetary Control

The Foundation of Modern Finance

Central banks have been the backbone of global finance for over a century. They hold significant power over economic stability through their monetary policy tools. Their main functions include controlling inflation, maintaining employment levels, ensuring financial stability, and acting as lenders of last resort during crises.

The Federal Reserve, European Central Bank, and other major central banks have shown their importance during economic crises. During the 2008 financial crisis and the COVID-19 pandemic, central bank interventions prevented a complete economic collapse. They used quantitative easing, interest rate changes, and emergency lending facilities.

Monetary Policy Mastery

Central banks keep economic balance through various policy tools. Changes in interest rates affect borrowing costs, investment choices, and spending patterns across economies. When inflation threatens stability, central banks may raise rates to cool off overheating markets. In contrast, during recessions, they lower rates to boost growth.

The accuracy of these tools has greatly improved. Modern central banks use big data, artificial intelligence, and machine learning to improve economic forecasting and policy effectiveness. For example, the Bank of England has successfully used unconventional monetary policies to manage the uncertainties of Brexit and the impacts of the pandemic.

The Trust Equation

Crucially, central banks offer something that cryptocurrencies have difficulty providing: institutional trust backed by government guarantees. Bank deposits are protected by government insurance, and central banks have built their credibility over decades of effective economic management. This trust leads to price stability. While Bitcoin’s volatility can exceed 200% each year, major fiat currencies usually show much lower volatility levels.

Limitations in the Digital Age

Traditional banking faces rising challenges in the modern financial system.

Cross-border payments are expensive and slow:

- Settlements can take several days.

- Fees range from 6–8% for international remittances.

- The correspondent banking network introduces multiple friction points.

- Developing countries suffer more due to weak banking infrastructure.

Financial exclusion remains a global issue:

- Low-income individuals and people in remote areas are disproportionately affected.

- 1.4 billion adults are still unbanked.

Banking requirements (minimum balances, documentation, physical branches) create barriers.

The Digital Revolution: Cryptocurrency’s Promise and Peril

The Decentralisation Advantage

Cryptocurrencies offer a fundamentally different approach to money. They allow peer-to-peer transactions without intermediaries and are available 24/7. They also enable programmable money through smart contracts. Bitcoin, as the leading cryptocurrency, has shown remarkable resilience, growing from an experimental idea to a market valued at over $2 trillion.

The decentralised finance (DeFi) ecosystem has grown rapidly. The market is expected to reach $231.19 billion by 2030, increasing at a rate of 53.7% each year. DeFi protocols allow lending, borrowing, and trading without traditional financial institutions. They often have lower fees and faster settlement times.

Financial Inclusion Revolution

Cryptocurrencies help fill important gaps in financial access. In Sub-Saharan Africa, only 49% of adults had bank accounts in 2021. Cryptocurrency adoption has surged as an alternative to traditional banking. Countries like Nigeria, Kenya, and South Africa lead the world in cryptocurrency use. Citizens use digital assets for remittances, savings to protect against inflation, and business transactions.

This technology requires only a smartphone and internet access, which are less demanding than traditional banking requirements. This accessibility has allowed millions of previously excluded individuals to join the global digital economy.

Innovation and Efficiency

Cryptocurrency transactions can settle in minutes instead of days, especially for cross-border payments. The costs of transactions are often lower than traditional banking fees. Bitcoin and Ethereum networks handle billions of dollars in transactions daily, showing the scalability and reliability that keep improving.

Smart contract functionality allows for programmable money, automated compliance, and complex financial products without traditional intermediaries. This innovation has created entirely new business models and financial products that wouldn’t be possible within standard banking systems.

The Volatility Challenge

However, cryptocurrency’s greatest strength—independence from central authority—is also its biggest weakness. Bitcoin’s price volatility is still significant, though it has decreased from triple-digit annual volatility to about 52% as of Q1 2025. This volatility limits how effective cryptocurrencies are as a stable unit of account or reliable store of value.

Market manipulation, regulatory uncertainty, and technological risks still affect the cryptocurrency ecosystem. The collapse of major exchanges like FTX revealed counterparty risks and highlighted the need for better consumer protection.

The Great Debate: A Head-to-Head Comparison

The gap between centralised finance and the growing world of cryptocurrency leads to a key debate about the future of money. To understand this conflict, we need to compare the two systems, plus their state-sponsored hybrid, the Central Bank Digital Currency (CBDC), based on their main features.

| Feature | Central Bank Fiat System | Cryptocurrencies (e.g., Bitcoin) | Central Bank Digital Currencies (CBDCs) |

| Issuer | Central Government/Bank | Decentralized Protocol | Central Government/Bank |

| Trust Mechanism | Institutional (Trust in government/law) | Algorithmic (Trust in code/math) | Institutional (Trust in government/law) |

| Supply Control | Discretionary Monetary Policy | Fixed/Algorithmic Scarcity | Discretionary Monetary Policy |

| Transaction Validation | Centralised or Hybrid System | Distributed Consensus (Miners/Validators) | Centralised or Hybrid System |

| Privacy | Pseudonymous (Bank secrecy laws) | Pseudonymous on a public ledger | Potentially low (programmable surveillance) |

| Key Strength | Stability through active management | Uncensorable freedom & predictable scarcity | Efficiency & direct policy implementation |

| Key Weakness | Inflation risk & censorship | Volatility & scalability limits | Centralised Intermediaries (Banks) |

Stability vs. Decentralisation: The Trust Equation

The main trade-off in this debate is between stability and decentralisation. Central banks and the fiat system they manage provide some stability, backed by the full trust, credit, and legal authority of the state. Monetary policy is actively managed to smooth business cycles, and institutions like deposit insurance protect consumers from bank failures. However, this stability comes at a cost: it demands complete trust in a small, unelected group of policymakers and the political institutions that oversee them. History has shown that this trust can be misplaced, leading to inflation, crises, and censorship.

Cryptocurrencies, on the other hand, offer a trustless system. You don’t need to trust any person or institution; you only need to rely on the integrity of the open-source code and the game theory that secures the network. This results in radical decentralisation and independence from control. The trade-off for this freedom is a significant lack of stability. Without a central authority to manage supply or intervene in crises, cryptocurrencies experience extreme price volatility, making them impractical for everyday use. Stablecoins aim to bridge this gap by tying their value to a stable asset, such as the U.S. dollar. Yet, they bring back the need to trust a central issuer and have shown vulnerability to collapse, as seen with the de-pegging of TerraUSD in 2022, which wiped out an estimated $60 billion in value.

Inflation Control: Monetary Policy vs. Algorithmic Scarcity

The two systems have fundamentally different ways of managing a currency’s value and controlling inflation. Central banks use active, discretionary monetary policy. They adjust interest rates to cool inflation or stimulate growth. This flexibility enables them to respond to changing economic conditions in real time. For example, after the pandemic, central banks worldwide implemented the most synchronised increase in interest rates in a generation to control rising prices. The downside of this approach is its reliance on the insight and skill of policymakers, who can face political pressure, flawed economic models, and human error.

Cryptocurrencies like Bitcoin offer a passive, rule-based alternative called algorithmic scarcity. Bitcoin’s supply schedule is fixed in its code and cannot be modified. Its total supply is limited to 21 million coins, and the rate of new issuance is halved roughly every four years during an event known as the “halving.” This predictable scarcity serves as a strong defence against the value loss often seen in fiat currencies. However, this rigidity has significant drawbacks. A fixed money supply cannot grow to meet the demands of an expanding economy or respond to sudden increases in money demand, like a financial crisis. In a severe downturn, this inflexibility could trigger a dangerous deflationary spiral, where falling prices and wages undermine economic activity—the very situation that modern central banking was established to avoid.

Regulation vs. Permissionless Innovation: The Rules of the Road

The final battleground is over governance. The traditional financial system relies on a complex set of regulations aimed at protecting consumers, ensuring financial stability, and preventing crimes like money laundering and terrorism financing. This is a permissioned system; financial institutions must be licensed and follow strict rules to operate.

In contrast, cryptocurrency emerged from a belief in permissionless innovation. Anyone, anywhere can write code, launch a new application, or join the network without seeking approval. This openness has sparked a wave of creativity, especially in Decentralised Finance (DeFi), which seeks to replicate traditional financial services like lending, borrowing, and trading on open, decentralised protocols.

However, the significant market crashes of 2022, including the failures of Terra/Luna and the FTX exchange, revealed the serious risks of an unregulated environment and led to a global push for regulations. Governments and regulators are now taking strong steps to impose rules on the industry. The debate focuses on finding a balance. On the one hand, regulation is needed to protect consumers from fraud and avoid systemic risks. On the other hand, there is a valid concern that overly strict or poorly designed rules could hinder the very innovation that makes cryptocurrency so transformative. This tension is pushing the industry to mature, shifting the mindset from “move fast and break things” to a more careful “move deliberately and build securely.”

Global Case Studies: Real-World Experiments

El Salvador’s Bitcoin Gamble

El Salvador adopted Bitcoin as legal tender in 2021, marking the first large-scale test of cryptocurrency as a national currency. The results have been mixed. The policy drew international attention and some investment, but economic challenges remained. By 2025, El Salvador changed its Bitcoin policy to make acceptance voluntary instead of mandatory. This change followed pressure from the International Monetary Fund during loan talks. The experiment revealed both the potential and the limits of using cryptocurrency on a national scale.

China’s Digital Yuan Dominance

China has become the global leader in CBDC development with its Digital Currency Electronic Payment system, known as the digital yuan. By 2024, it had over 260 million users and transactions that exceeded $7 billion. China’s CBDC is the most advanced example of a national digital currency in use. The digital yuan keeps government control while providing digital convenience and allows for programmable money with built-in policy tools. However, privacy issues and the potential for increased surveillance have raised international concerns.

India’s Balanced Approach

India’s CBDC pilot program involves over 5 million users across 16 participating banks and takes a cautious approach to its rollout. The Reserve Bank of India stresses the importance of thorough testing before a full rollout. It focuses on both retail and wholesale CBDC applications. This careful approach stands in contrast to more aggressive strategies seen elsewhere. It could offer valuable insights into sustainable practices for adopting CBDCs.

European Union’s Regulatory Leadership

The EU’s Markets in Crypto-Assets regulation, launched in 2024, created clear frameworks for cryptocurrency and stablecoin operations. This regulatory clarity has made Europe a potential hub for compliant cryptocurrency businesses while ensuring consumer protection. The EU’s strategy shows how established regulatory frameworks can adjust to support cryptocurrency innovation while keeping financial stability intact.

The Battle Narrative: Cooperation vs. Competition

The Hybrid Future

Instead of a complete replacement, the future will likely see cryptocurrency innovation integrated within regulated frameworks. Central Bank Digital Currencies represent this mixed approach by combining government support with digital efficiency.

Many central banks are looking into programmable features inspired by cryptocurrency, while still keeping centralised control. This method could offer the advantages of both systems while reducing their risks.

Institutional Adoption Trends

Major financial institutions are increasingly providing cryptocurrency services, such as Bitcoin ETFs and corporate treasury allocations. BlackRock, Fidelity, and other large institutions have introduced cryptocurrency investment products. This legitimises digital assets in traditional finance.

This shift suggests that coexistence is more likely than replacement.

Regulatory Convergence

Global regulatory frameworks are changing to accommodate cryptocurrency instead of banning it. Stablecoin regulations in the US, EU, and Asia focus on ensuring reserve support and protecting consumers while allowing for innovation.

The GENIUS Act in the US Senate and similar laws around the world show a growing acceptance of cryptocurrency within controlled limits.

Technology Integration

Payment networks are increasingly adding cryptocurrency features. Visa, Mastercard, and other traditional payment processors now support stablecoin transactions, allowing cryptocurrency to work within existing financial systems.

Economic Impact Analysis: Winners and Losers

Developing Economy Advantages

Cryptocurrencies provide specific benefits for developing economies that have limited banking systems. Countries facing currency instability or high inflation find cryptocurrencies appealing as a hedge against local currency devaluation.

Cross-border remittances are essential for many developing economies and greatly benefit from cryptocurrencies’ lower costs and faster settlement. Traditional remittance fees of 6-8% can drop to under 2% when using cryptocurrency channels.

Developed Economy Considerations

In developed economies with well-established banking systems, adopting cryptocurrencies faces greater challenges. Existing financial structures perform quite well, which diminishes the appeal of cryptocurrencies for everyday transactions.

Nonetheless, investment interest remains robust. Many view cryptocurrencies as a way to diversify their portfolios, similar to gold or other alternative assets.

Central Bank Policy Implications

Widespread adoption of cryptocurrencies could hinder central banks’ ability to implement monetary policy effectively. If large segments of the economy use cryptocurrencies for transactions, traditional policy tools might become less effective.

However, current adoption levels are not high enough to threaten the effectiveness of monetary policy. Even at peak market capitalisations, cryptocurrency makes up a small percentage of the global money supply.

Financial System Stability

The volatility of the cryptocurrency market poses potential risks to financial stability if adoption grows significantly. However, the current size of the market and its limited integration with traditional finance help contain systemic risks.

Central Bank Digital Currencies (CBDCs) could offer a potential solution by providing the benefits of digital currency while preserving control over central bank policy.

Conclusion: The Dawn of Digital Money 2.0

The clash between traditional central banking and the rising power of cryptocurrency is more than just a tech shift; it represents a worldwide debate on trust, privacy, and economic authority. We are entering a new era known as Digital Money 2.0, where the definition of money is being challenged and reshaped.

Central banks, the creators of the 20th-century monetary system, are not sitting back. They are tackling the digital challenge by adopting its technology and developing Central Bank Digital Currencies to improve the efficiency and reach of government money. They aim to create a smoother version of the current system, which strengthens their role in the economy and gives them new tools for policy execution and economic oversight.

In sharp contrast, cryptocurrencies present a bold alternative. Built on principles of decentralisation and mathematical verification, they propose a financial system where verified code replaces institutional authority. This model emphasises personal freedom, unrestricted access, and resistance to censorship, offering a way out of the drawbacks of the centralised system, like inflation, exclusion, and control.

The way ahead is unclear, filled with tech challenges, regulatory conflicts, and significant societal decisions. Global experiments, from China’s controlled launch of the e-CNY to El Salvador’s tumultuous acceptance of Bitcoin, are providing early and often contradictory insights. The future will likely not be a single, uniform currency. Instead, we are moving towards a more complicated and divided landscape where state-backed CBDCs, regulated private stablecoins, and decentralised cryptocurrencies coexist, each fulfilling different roles and meeting various needs.

The questions this new era raises are some of the most crucial of our time. Will we value the managed stability and possible surveillance of state-backed digital currency, or the unpredictable freedom of an unrestricted system? How will we find a balance between consumer protection and the push for innovation? The choices we make will shape not only the future of our finances but also the relationship between individuals, markets, and governments for years to come. The record of civilisation is being rewritten in digital code, and the next chapter has only just begun.

The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over…

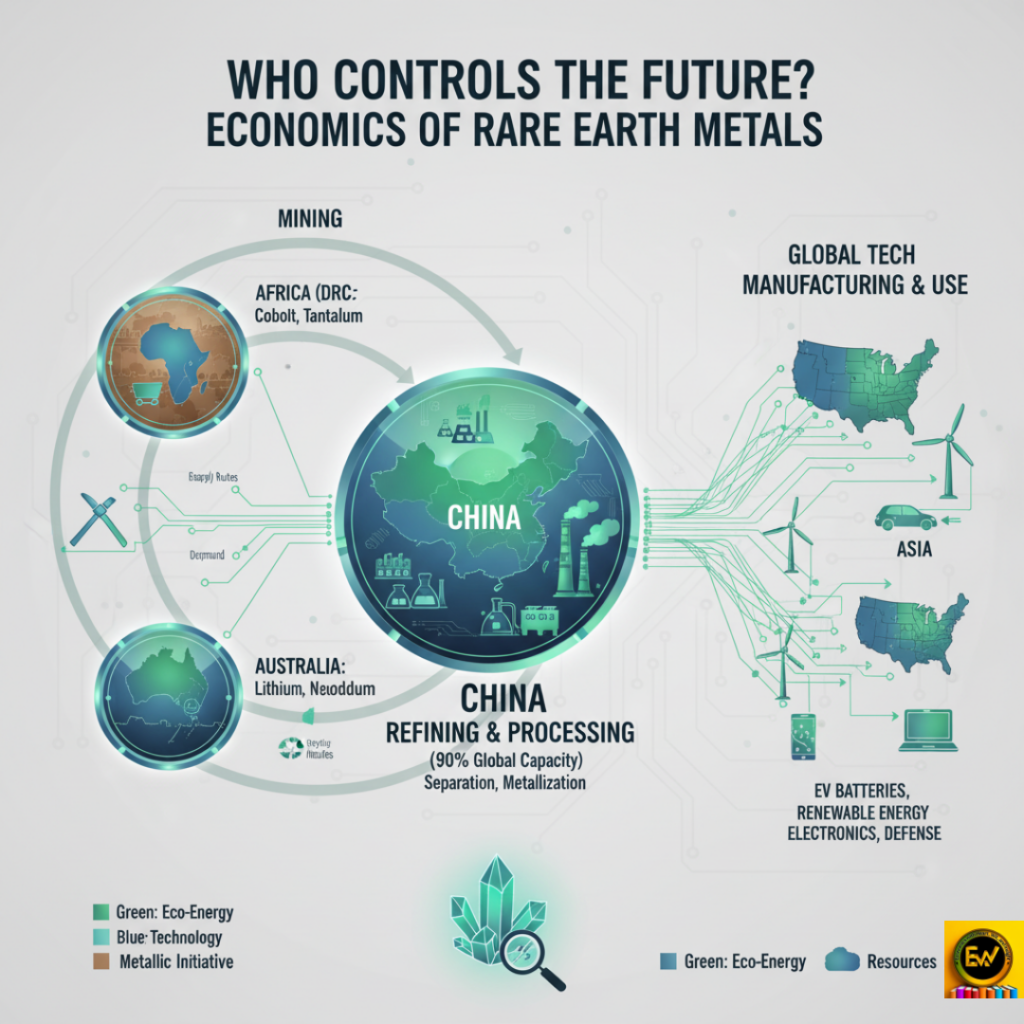

Economics of Rare Earth Metals

Rare earth elements and critical minerals are vital for clean energy and technology. They form…

Indian Rupee Depreciation Against the US Dollar

Introduction In recent years, the Indian Rupee has undergone significant depreciation against the US Dollar,…

Green Economy: Can India Balance Growth with Climate Goals?

India stands at a crucial point in history. As the world’s most populous nation and…

“Understanding ‘67’: The Viral Gen Alpha Slang That Became Word of the Year 2025”

Source – The Economic Times Every year, Dictionary.com selects a term that captures the spirit…

BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving…

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/vi/register?ref=MFN0EVO1

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your enticle helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/uk-UA/register?ref=XZNNWTW7

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.info/pt-PT/register-person?ref=KDN7HDOR

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/register?ref=IXBIAFVY