Geopolitical Events and the Global Economy

Introduction

“In today’s world, wars are not only fought on battlefields but also in trade, technology, and supply chains.” This is more than a slogan; it captures the new logic of global economic risk. Political tensions, trade disputes, sanctions, and technology separation now quickly lead to higher prices, broken supply chains, and capital flight. Yet the real cost is often the uncertainty that comes before or surrounds these events. Investors delay projects, firms change supply chains, and consumers face higher bills as confidence drops.

From the U.S.-China tariff disputes to the Russia-Ukraine war and ongoing Middle East conflicts, the past five years have shown how shocks affect markets and border crossings. At the same time, regional trade agreements like RCEP and modernised deals such as USMCA show that integration is still possible but only when politics and policy work together. This article explains how geopolitical economic transmission works, analyses four significant case studies, and outlines the policies and business strategies needed to succeed in an era of geo-economic division.

The Transmission Channels of Geopolitics into the Economy

Geopolitical events impact the economy through various, often interconnected channels. You can think of them as the mechanics of contagion.

Financial markets: Political shocks cause a “flight to safety.” Equity sell-offs, bond rallies in safe-haven markets, and currency swings are usually the first signs. Emerging-market capital outflows and currency depreciation follow, leading to higher borrowing costs and increased imported inflation.

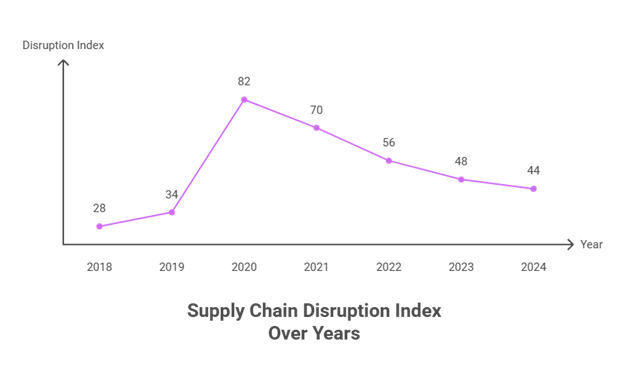

Supply chains: Tariffs, sanctions, and bans change how we manufacture and move goods. Disruptions raise input costs, create shortages, and push firms into “China+1,” near-shoring, or friend-shoring strategies. These changes trade efficiency for resilience, which raises unit costs and slows down investment.

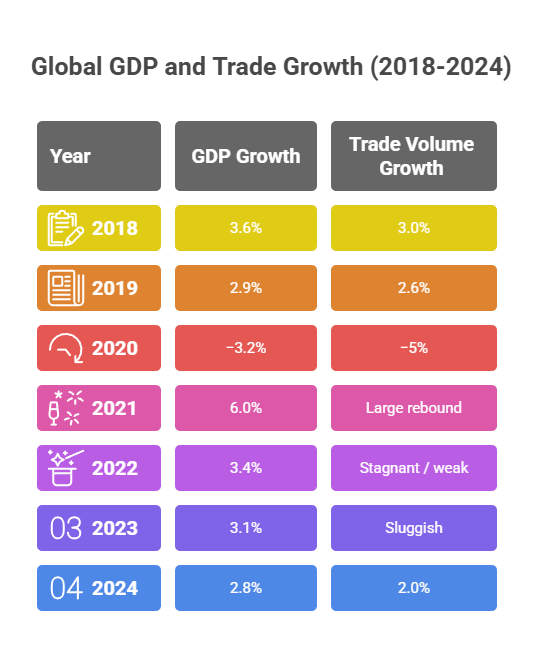

Trade and growth: Tariffs act like hidden consumption taxes. They squeeze households and lower GDP. Even small barriers create policy uncertainty that cuts business investment and long-term productivity. OECD and WTO analyses show trade growth has lagged behind output since 2018 as policy frictions increased.

FDI and real investment: Political instability discourages long-term foreign investment. Studies find significant reductions in FDI and ongoing GDP losses after political shocks. These effects can last for years. In short, geopolitics compresses both demand through inflation and confidence, and supply through disrupted production and lower investment.

Case Studies

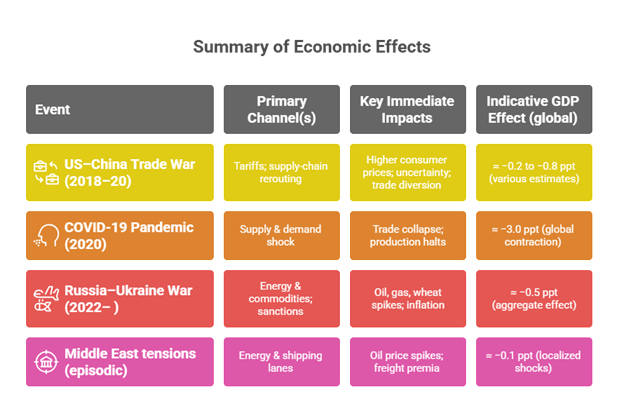

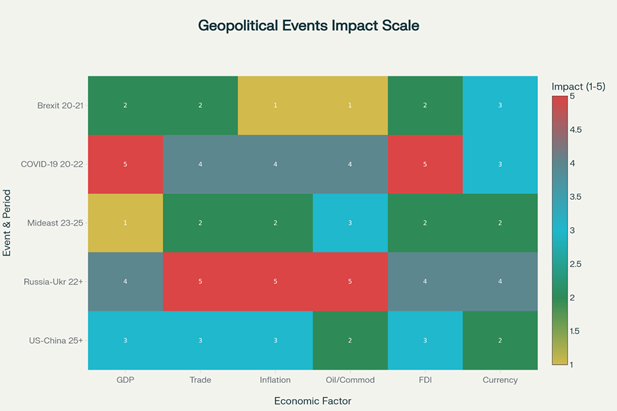

US–China Trade War

The US-China tariff conflict turned geopolitical rivalry into a straightforward economic policy. Rapidly rising tariffs increased costs for manufacturers that depended on cross-border inputs. This forced U.S. importers to look for sources in third countries; this trend is known as “trade diversion.” Consumers felt the impact through higher prices. Downstream industries lost their edge as the cost of intermediate goods increased. Frequent policy changes and threats created uncertainty, which reduced investment even in sectors not directly affected. Although some manufacturing jobs were saved through protection, the overall result was lower efficiency and slower innovation. Firms shifted production away from their strengths.

Russia–Ukraine Conflict

The Russia-Ukraine war significantly impacted supply chains. Together, the two countries used to provide a large portion of the world’s wheat and were major exporters of fertilisers and essential metals. Russia was an important energy supplier for Europe. Sanctions and disrupted Black Sea routes led to sharp increases in prices for grain, fertilisers, and energy, pushing inflation higher around the globe. Europe faced severe energy shortages, prompting emergency policies and financial support, while food insecurity grew in at-risk areas. The conflict also sped up shifts in trade patterns. Russian energy supplies moved toward Asia, changing regional dependencies and showing how sanctions can alter trade rather than just stopping it.

Middle East Tensions

Instability in the Middle East is unpredictable for global energy markets. Even small conflicts, when they threaten key areas like the Strait of Hormuz, can raise expectations for oil and freight rates. This leads to price spikes that contribute to consumer inflation and higher production costs. Since energy is a common input, these disruptions may cause stagflation, which is low growth alongside high inflation, in countries that rely on energy imports. Additionally, rising shipping risks increase freight costs and can quickly disrupt just-in-time supply chains. This forces companies to reconsider their reliance on maritime routes and regional suppliers.

Brexit

Brexit shows how changes in politics within a major economy can lead to long-term costs. New customs checks, different regulations, and the relocation of financial services have reduced trade volumes and investment flows. Studies indicate that the UK’s GDP is significantly lower than predictions would suggest if the country had stayed fully connected to the EU single market. This situation has resulted in higher living costs and disrupted supply chains. Brexit highlights that even political decisions not related to military issues can have economic costs lasting decades when they change access to markets and affect regulatory certainty.

India–US Trade Conflict (Russia Oil Ties)

India’s discounted Russian oil imports surged after the 2022 Ukraine invasion, initially tolerated by Washington as a way to cap global oil prices. However, the US later came to view these purchases as sanction evasion that indirectly funds Russia’s war. In August 2025, Washington imposed a 25% tariff on Indian imports, later raising it to 50% on several goods, triggering sharp tensions. New Delhi condemned the move as “unjustified,” pointing to Western double standards while reiterating that energy security requires continued Russian oil imports. Economically, the tariffs threaten to wipe out the ~$17 billion India saved through discounted crude and could reduce nearly $37 billion worth of Indian exports to the US, especially in key sectors like textiles and gems, risking job losses. With the US importing around $87 billion of Indian goods in 2024, buyers may now shift to alternative suppliers. High-level talks between the two nations are underway, but analysts believe Washington is leveraging tariffs to push for broader trade concessions, particularly in agriculture.

Major Geopolitical Events and Their Economic Impacts (2020-2025)

The Counterbalance: International Agreements & Cooperation

While conflicts create divisions, deep trade agreements help reintegrate and stabilise regions. The Regional Comprehensive Economic Partnership (RCEP) and USMCA are recent examples showing that integration still has benefits. They lower tariffs, standardise rules, and create reliable frameworks for investment and trade. RCEP, for example, covers a large part of Asia-Pacific trade and promises tariff cuts and rules that support regional value chains. USMCA updated North American rules on autos, labour, and digital trade, improving predictability.

However, the benefits depend on “depth.” Agreements that include regulatory cooperation, intellectual property rules, and dispute resolution, known as deep integration, offer more lasting stability than agreements focused only on tariffs. In short, strategic diplomacy and focused integration can counteract fragmentation, but only if political will matches economic planning.

| Agreement | Key economic impacts (select) | Core provisions |

| USMCA | +$68.2bn US real GDP; ~176k US jobs (estimates) | Higher auto rules of origin, labour, and digital trade provisions |

| RCEP | Projected +$209bn annually to incomes; +$500bn trade by 2030 (studies) | Higher auto rules of origin, labour, and digital trade provisions |

The Future of Geo-Economics

The next decade is likely to see major shifts instead of just short-term shocks.

Fragmentation is taking precedence over globalisation. We can expect more friend-shoring and near-shoring. Supply chains will be restructured with political alignment in mind. This will reduce efficiency but strengthen resilience. As a result, new winners will emerge, such as Mexico and Vietnam, while some low-cost exporters may struggle.

Technological sovereignty is becoming important. The competition over AI, semiconductors, and advanced manufacturing will push countries to localise critical parts of the value chain. Policies that limit exports of chips or design tools will create separate technology ecosystems and slow the global spread of innovation.

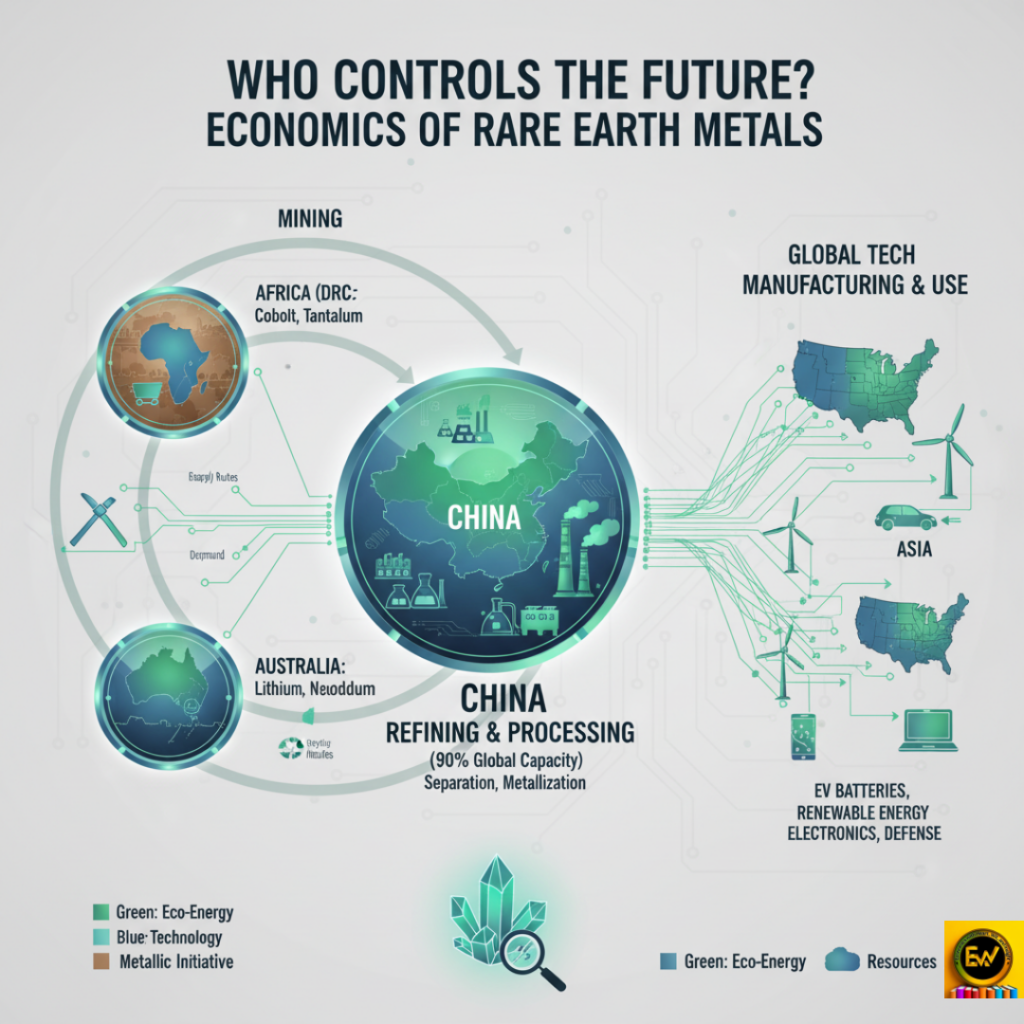

Climate change and critical minerals are also significant factors. The shift to clean energy increases the geopolitical importance of rare earths and battery minerals. Controlling these supply chains has become a strategic goal.

Financial splintering is another trend. The ongoing use of sanctions and defensive financial systems might encourage the development of alternative payment methods and partial de-dollarisation in some regions. This will lead to a more multipolar financial landscape, making it more complicated for global investors.

Overall, these trends indicate that geopolitical risk is no longer just a rare concern; it is now a consistent structural aspect. Companies will need to trade off some short-term cost efficiency for long-term resilience.

Conclusion & Takeaways

Uncertainty is the most costly weapon today. Geopolitical events spread quickly through financial markets, supply chains, trade policy, and investment flows. They cause immediate volatility and long-term structural damage. The evidence is clear. Since 2018, repeated shocks have slowed trade growth, increased inflation, and shifted investments along geopolitical lines. However, the outlook isn’t entirely grim. Strong, high-quality trade agreements and solid policy frameworks can bring back predictability and open new growth paths.

Policymakers have a twofold task. They need to strengthen institutions to attract long-term capital and pursue focused integration that maintains market access while protecting strategic interests. Businesses and investors must make resilience a priority. Scenario planning, diversified sourcing, and smart capital allocation will become the new standard. Countries and companies that focus on resilience instead of just efficiency will be in the best position to influence the next era of the global economy. Those that build resilience, not just efficiency, will shape the future global economy.

The Indo-Pacific: A Geoeconomic and Strategic Epicenter

The Indo-Pacific has become the world’s most dynamic economic region. It is home to over…

Economics of Rare Earth Metals

Rare earth elements and critical minerals are vital for clean energy and technology. They form…

Indian Rupee Depreciation Against the US Dollar

Introduction In recent years, the Indian Rupee has undergone significant depreciation against the US Dollar,…

Green Economy: Can India Balance Growth with Climate Goals?

India stands at a crucial point in history. As the world’s most populous nation and…

“Understanding ‘67’: The Viral Gen Alpha Slang That Became Word of the Year 2025”

Source – The Economic Times Every year, Dictionary.com selects a term that captures the spirit…

BRICS Expansion 2025: Can It Challenge the Dollar’s Dominance?

The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, has been evolving…

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/es-AR/register?ref=UT2YTZSU

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/kz/register-person?ref=K8NFKJBQ

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/ur/register?ref=SZSSS70P

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/ru/register?ref=O9XES6KU

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.info/register-person?ref=IHJUI7TF

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?