Indian Products Face Demand Slump in US, Jobs at Stake

From Wednesday, a steep 50 per cent tariff will be imposed on Indian products entering the United

States, threatening exports worth $45.2 billion. The move is expected to significantly increase the cost of Indian goods in US markets, eroding their competitiveness against lower-tariff exporters such as Vietnam, Bangladesh, and Malaysia. Experts warn that this development could disrupt manufacturing, dampen job creation, and derail India’s broader ambitions of becoming a global manufacturing hub powerhouse.

According to Raphael Luescher, Co-Head of EM Equities at Vontobel, “The higher tariffs could severely affect India’s manufacturing aspirations. Many companies impacted by these duties may postpone investment decisions, which in turn will restrict job creation.” Textile, footwear, jewellery, and auto parts producers are under the heaviest strain. Analysts project that

in the coming 12 months, between one and 1.5 million jobs could be lost across these sectors. The

textile sector may lose over 100,000 positions, while the diamond and jewellery hubs in Surat and

Mumbai are also at risk of shedding more than 100,000 jobs each.

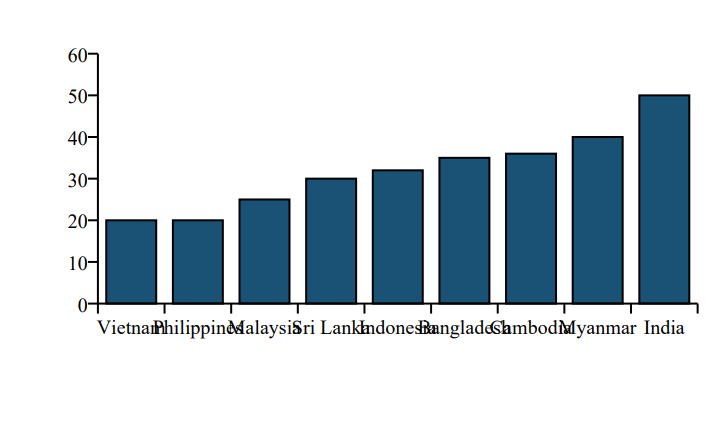

Global Tariff Disparity

| Country | Tariff (%) |

| Vietnam | 20 |

| Philippines | 20 |

| Malaysia | 25 |

| Sri Lanka | 30 |

| Indonesia | 32 |

| Bangladesh | 35 |

| Cambodia | 36 |

| Myanmar | 40 |

| India | 50 |

Sector-wise Impact

Textiles and Apparel: Losing Global Market Share

India exports $10.3 billion worth of textiles and apparel to the United States, which accounts for a third of its total garment exports. With the new tariffs, Indian apparel becomes prohibitively expensive compared to low-cost rivals like Bangladesh and Vietnam. Reports already indicate shutdowns in key hubs such as Tirupur, Noida, and Surat.

Basmati Rice: Minimal Threat

India exports around 6 million tonnes of basmati to 127 countries, but only 270,000 tonnes (4 per cent) go to the US. The additional tariffs are unlikely to cause major losses since exporters can redirect shipments elsewhere.

Gems and Jewellery: Severe Setback. With $12 billion worth of gems and jewellery exports to the US annually, the sector is staring at a deep crisis. Higher tariffs on diamonds and gold ornaments will allow Chinese exporters to seize market share. Rajesh Rokde, Chairman of the All India Gems and Jewellery Domestic Council, warned that over 100,000 livelihoods may vanish abruptly.

Seafood: Partly Resilient India sells about $2.2 billion worth of seafood to the US. While tariffs increase export costs, the industry is more geographically diversified and could redirect shipments to other countries.

Policy Recommendations & Possible Government Response

- Diversification of Export Markets: Reduce over-dependence on the US by expanding into African,

Middle Eastern and Latin American markets. - WTO Action and Bilateral Negotiations: Challenge the tariff hike at the WTO and pursue negotiations

with Washington for relief. - Targeted Subsidies and Support Packages: Textile and jewellery exporters may need direct relief and

incentives to stay competitive. - Production-Linked Incentives (PLI) Expansion: Expand PLI schemes for labour-intensive industries.

- Boosting Domestic Value Chains: Invest in technology, skills, and efficiency to reduce production

costs. - Strengthening Regional Trade Pacts: Accelerate agreements like the India-EU FTA to find new

opportunities.

Conclusion

The US tariff escalation is not just a short-term export disruption but a direct challenge to India’s global trade ambitions. Without immediate and strong policy intervention, India risks losing millions of jobs and undermining the vision of becoming a global manufacturing leader. New Delhi’s response in the coming months—through trade negotiations, relief packages, and market diversification—will determine whether Indian exporters weather the storm or face a prolonged crisis.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/ph/register?ref=IU36GZC4

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/es-MX/register?ref=GJY4VW8W

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/de-CH/register?ref=W0BCQMF1

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.